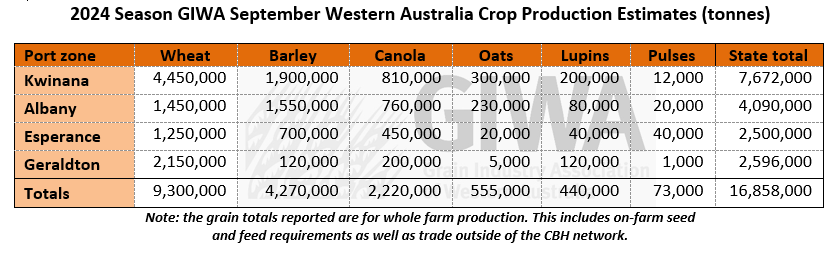

The 2024 Grain Season – Lack of spring rain now starting to bite

The lack of spring rain across the grain growing regions of Western Australia has resulted in what was, over the last two months an increasingly high potential tonnage year, to now looking less likely. The state’s crop was in very good shape up until recently and the potential tonnage was climbing from the previous GIWA Crop Report in early August to a point where we were looking at a very good year. However, the complete lack of finishing rains has now put a question mark over final tonnage. There are still areas in the southern regions that could recover grain yield potential if they receive 20 mm of rain in the next two weeks, although without this, the total tonnage for the state could be closer to 15 million tonnes rather than 17 million tonnes as it stands now.

Grain yields have started to slide in many regions of the state with the large area of wheat the most affected. There is around 500 thousand hectares more wheat area this year than last year, and most of this increase is on fallow. Nearly 900 thousand hectares of crop has been planted on fallow, which is three times the area planted on fallow last year. While the wheat area on fallow (17% of the total wheat area) will tend to buffer the slide in wheat yield potential to some degree, it is very difficult to finish off wheat with little or no spring rain and it is the normally more reliable rainfall regions that are suffering the most.

The lack of finishing rains in September to date, combined with the warm sunny days, has had crops digging deep for residual sub-soil moisture. However, moisture reserves are low this year due to below average growing season rain for all regions other than the Geraldton port zone. The top growth has ended up above average due to the very good growing conditions in August and these “topped up” crops are now using up to 20 mm of soil moisture per week to stay alive.

Without further rain in the next two weeks, the slide in tonnage will continue.

On the plus side of the equation, the very large area of barley (1.8 million hectares) is in good shape as it is ahead of wheat in terms of grain-fill. The barley, in general, has had a dream run this year with low levels of disease and the lack of waterlogging in the lower lying areas where barley is often targeted. There has also been no frost to speak of and this has helped to keep tonnage estimates higher than they may have otherwise been.

Canola crops in the medium and low rainfall areas were late to emerge and did not have time to put on the growth that is necessary to support high grain yields. The heat has halted flowering and put a lid on extending potential yield if there is rain in the next few weeks. The higher rainfall zones are in better shape, although they are in line for more longer-term average yields rather than recent higher yields.

Lupin crops are generally well grown and have a lot of biomass, although there are few pods. This will be a benefit to following crops next year, but many lupin crops won’t deliver a profit this year.

Seasonal Outlook

Ian Foster, Department of Primary Industries and Regional Development

Seasonal Climate September 2024

Rainfall

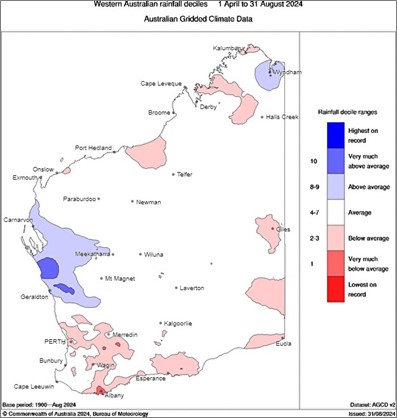

August brought welcome rain for much of the Southwest, the Great Southern and South Coast. However, seasonal rainfall (April to August) remains lower than normal for parts of the southern, central and southeast cropping areas (see Figure 1).

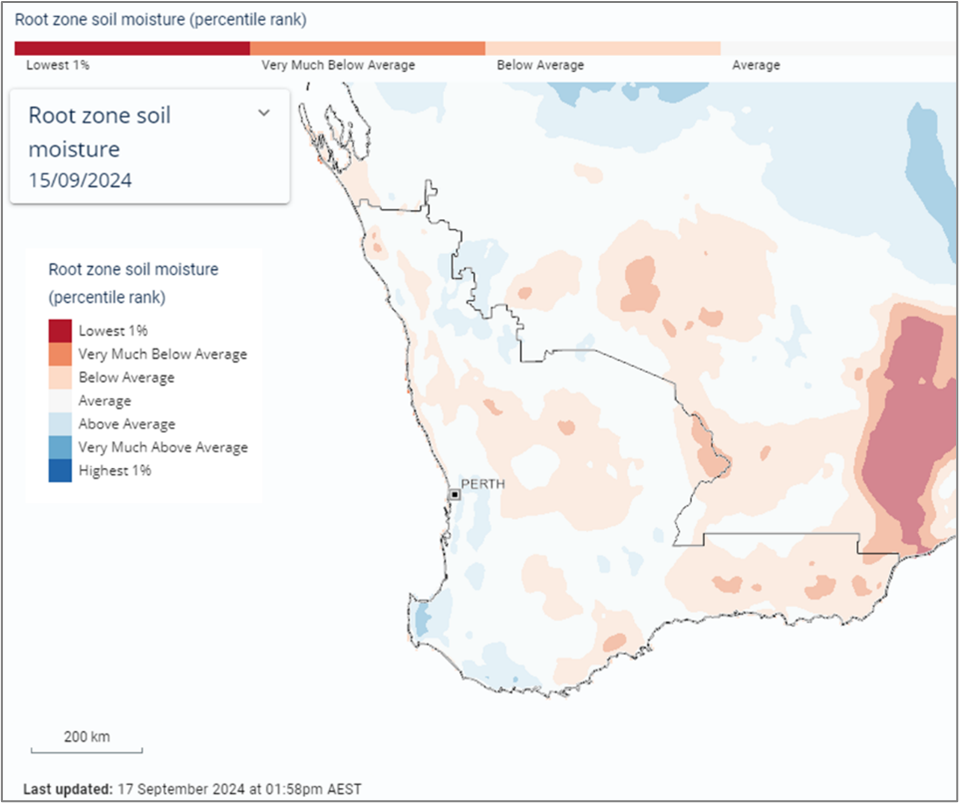

September has seen little rain for eastern regions and parts of the South Coast, and coupled with above normal temperatures, soil moisture storage is lower than normal over much of the cropping area, including the South Coast (see Figure 2).

Forecast

Climate conditions in the Indian and Pacific Oceans are neutral. Although some atmospheric indicators in the Pacific have recently developed to look more like a La Nina, it remains to be seen whether these conditions will be sustained.

Half of climate models predict conditions in the tropical Pacific reaching La Nina from October, with the remaining models indicating a near La Nina state. If an event develops in coming months, it is forecast to be relatively weak and short-lived. This has more impact on rainfall for eastern Australia than southern WA.

The Southern Annular Mode has been in its positive mode in the first half of September and is likely to have been responsible for the drier start to the month. It is predicted to relax to neutral conditions for the rest of September and into early October. Short-term forecasts indicate some rain is likely in the last week of September.

The Bureau of Meteorology’s seasonal outlook for October to December indicates neutral-to-drier rainfall for much of the cropping area. Many international climate models have a neutral outlook for this period. These factors, coupled with forecasts of warmer temperatures and increased risk of unusually high daytime temperatures, suggest the chances of adding to soil water storage are limited for the rest of the growing season.

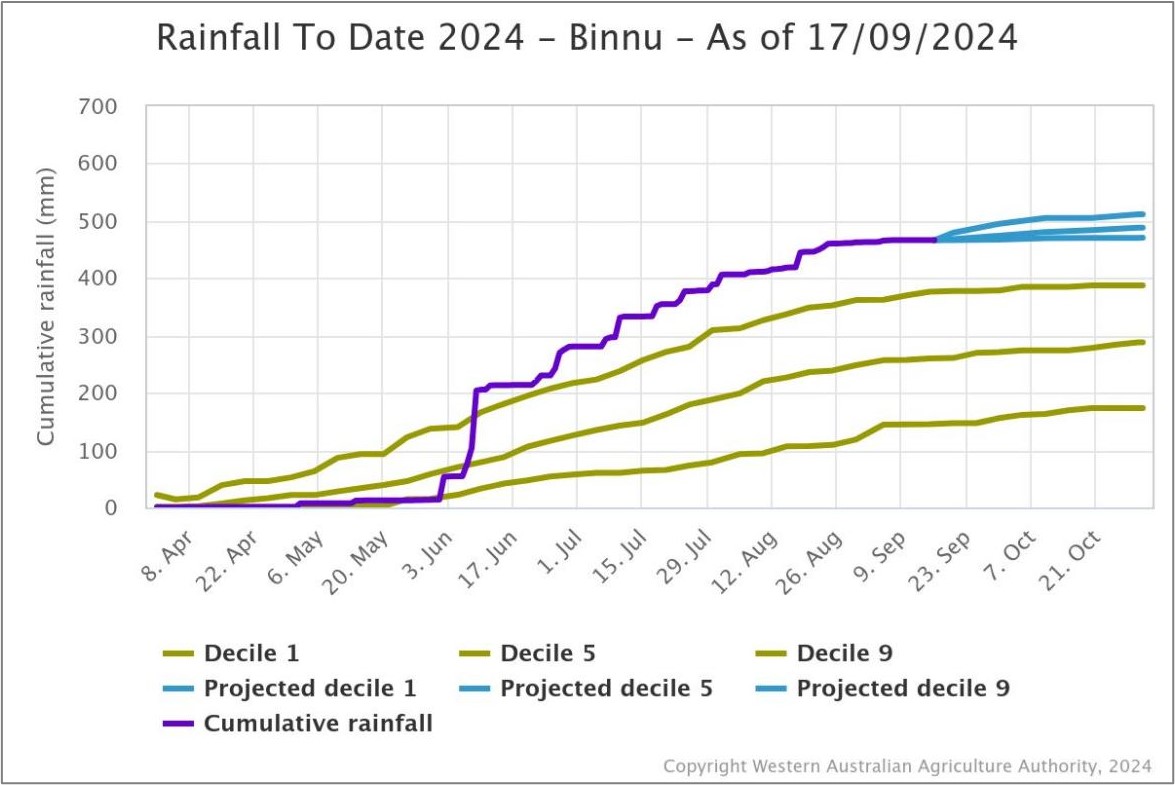

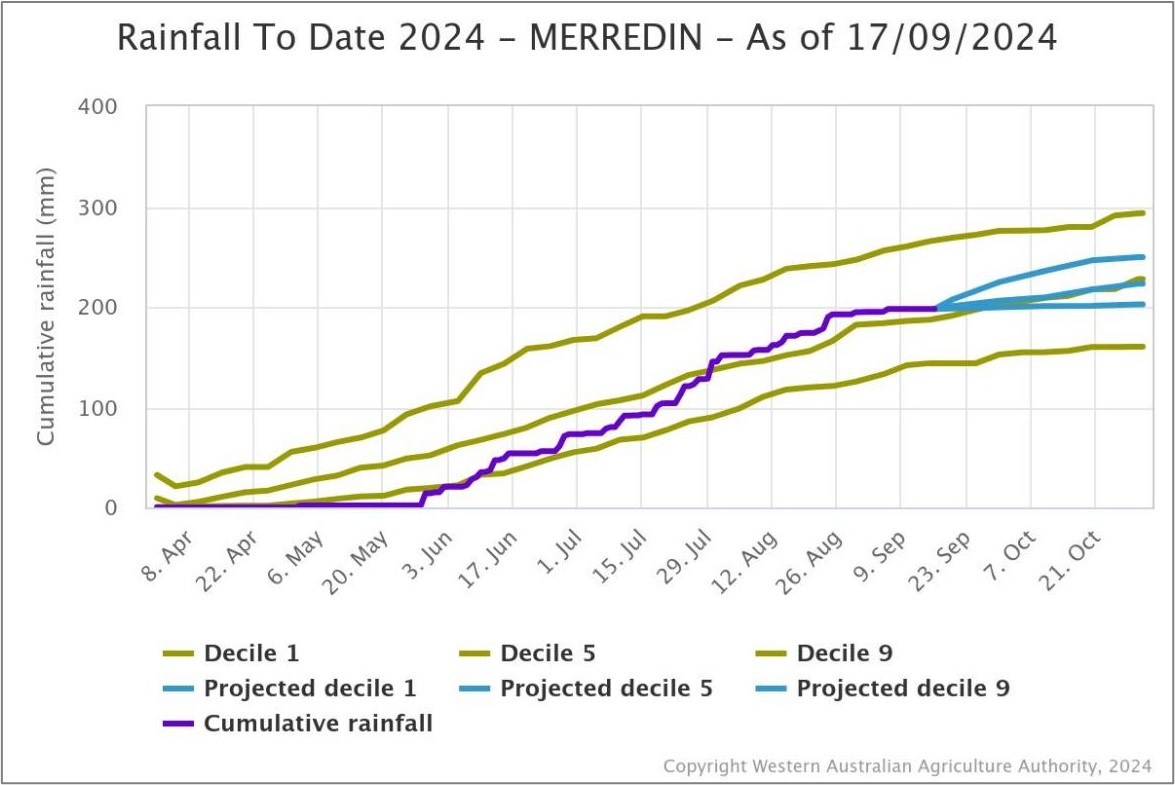

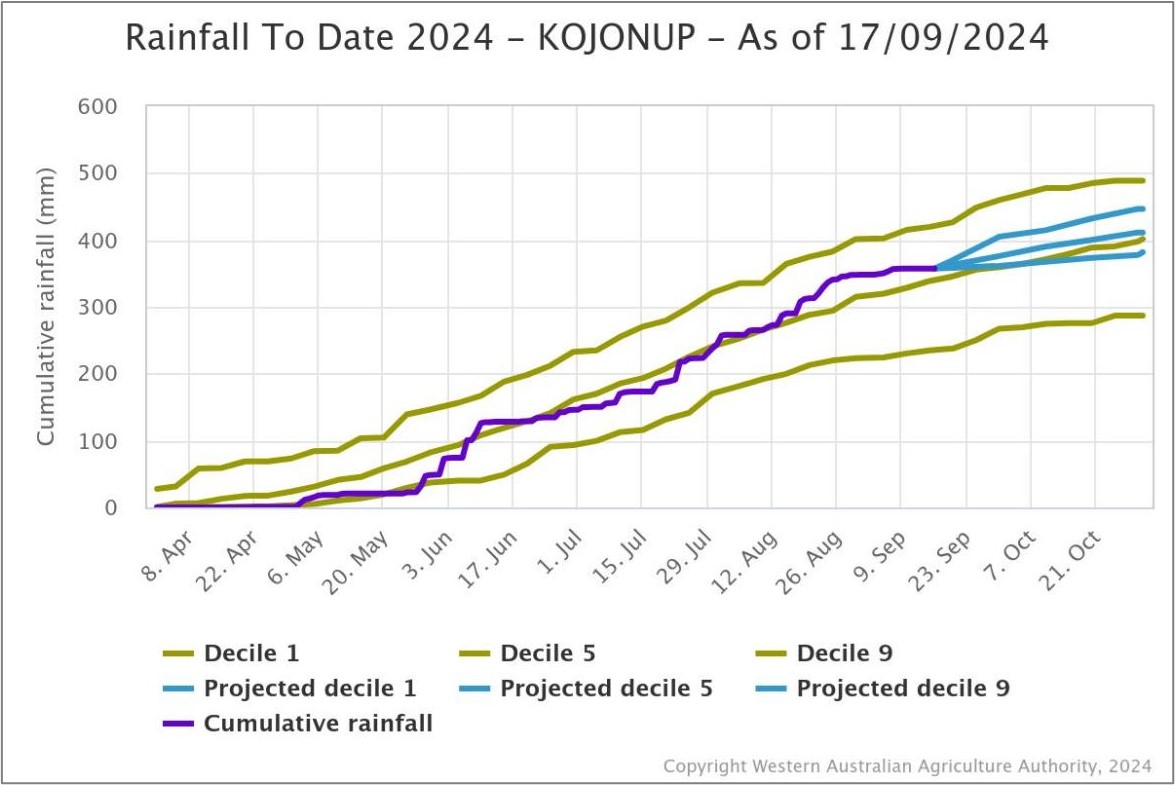

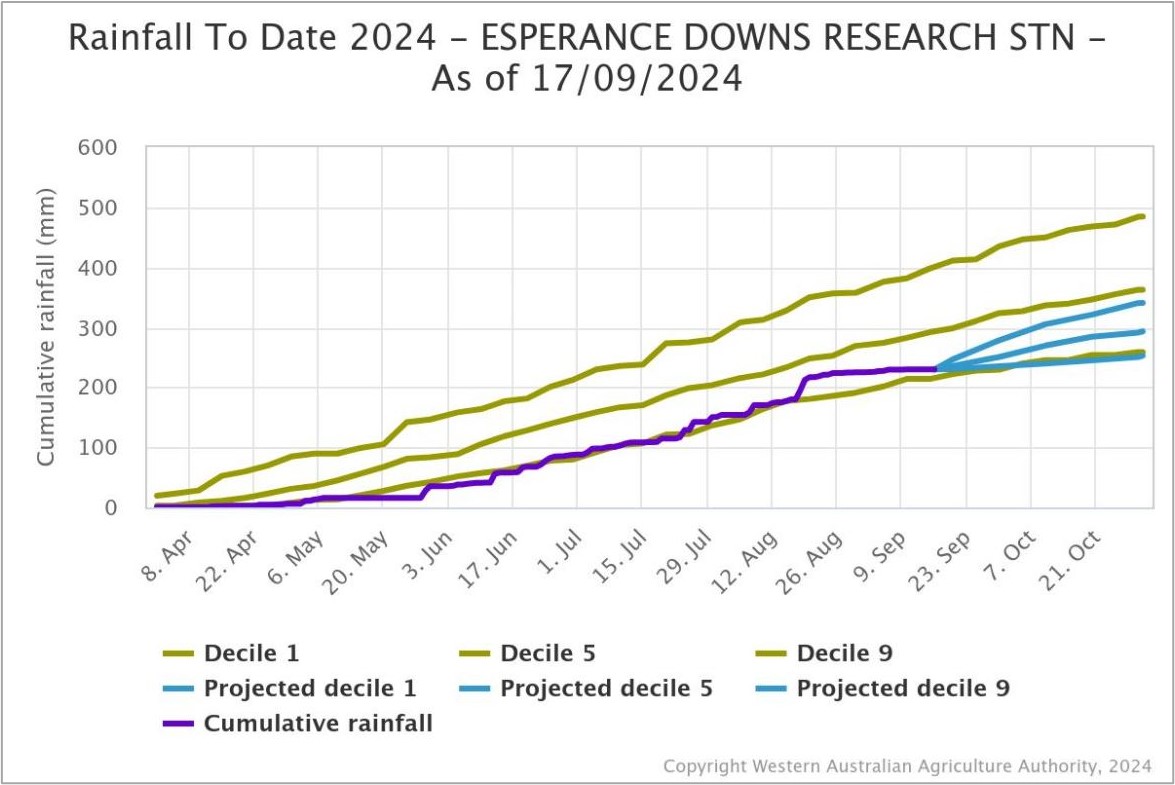

Good rain in July and August has improved seasonal rain accumulation for many locations. In Figures 3 to 6, cumulative rain is shown against historical percentiles for selected locations. These charts enable comparison between rainfall received and historical records and provide some context to the current season and how it’s tracking.

The purple graph line shows current rainfall received. Extending out from the solid purple line are three light blue lines, which represent a range of historical finishes (dry, average or wet) to the season from the current date onwards.

The contrast in seasonal conditions between north and south is marked, with Binnu tracking very wet, compared with Esperance which requires well above average rain for the rest of the season to make average (Figure 6).

The improvement in seasonal conditions over June and July for Kojonup (Figure 5) and Merredin (Figure 4), have flattened from late August. This is consistent with declining soil water storage.

Figure 1: Rainfall deciles for April to August 2024. Source: Bureau of Meteorology (2024)

Figure 2: Estimated root-zone soil water percentiles 15 September 2024. Source: Bureau of Meteorology (2024)

Figure 3: Cumulative rainfall from 1 April to 17 September 2024 at Binnu. Source: DPIRD

Figure 4: Cumulative rainfall from 1 April to 17 September 2024 at Merredin. Source: DPIRD

Figure 5: Cumulative rainfall from 1 April to 17 September 2024 at Kojonup. Source: DPIRD

Figure 6: Cumulative rainfall from 1 April to 17 September 2024 at Esperance Downs Research Station. Source: DPIRD

Temperature

Seasonal temperatures throughout winter have been very much above normal and are likely to have promoted crop growth. Seasonal forecasts indicate warmer conditions will persist through spring.

The Bureau’s climate model indicates the frost risk over September and October is lower than normal, while the risk of unusually high daytime temperatures is above normal.

Additional information is available from:

BoM: Decile rainfall for April to August 2024

BoM: Rainfall outlook for the next week

BoM: Seasonal Rainfall Outlook

Geraldton Zone

Crops in the eastern part of the Geraldton port zone have higher potential than those in the west, which is a reversal of what we see most years. The lack of spring rain has accentuated this difference with the heat being turned on over the last few weeks. The lower water holding capacity soils closer to the coast are sweating off grain yield in front of your eyes, whilst the heaver soils in the east are still in very good shape for returning above average grain yields. There was a large area of wheat sown on fallow from 2023 and this, combined with above average growing season rain, has resulted in these low rainfall areas behaving more like the medium to high rainfall zones.

The majority of the crop area is wheat this year and the wheat has managed the extreme conditions better than the canola and lupins, which will both be well down on average grain yields. The late start never really gave canola a chance and this is going to be reflected in a very low tonnage year in the region. Many of the lupins have grown well although they have few pods, which will be good for next year’s crop but not for profit this year.

Kwinana Zone

Kwinana North Midlands

Growing conditions for the region were very good in July and August, but now the heat has arrived and with the tap turned off, the crops are noticeably going backwards. Rain in the next two weeks could hold the slide in grain yield, although without rain current potential could drop by 20% across the board, particularly for the wheat. The barley is well into grain-fill and will be less affected, although the more bulked up crops are now starting to go silvery white, which is a sign of severe moisture stress.

Wheat crops were set up well for a very good year flowering five wide, although most are back to filling three to four wide now. With the ramping up of the heat in the last few weeks, canola crops dropped the last of their flowers while the lupins turned their toes up and have started dropping leaves and the last of their flowers. Most canola crops lack bulk and are way too easy to walk through.

Neither the canola or the lupins will reach any great heights this year and while the wheat could recover some lost potential, we need a pretty good rain this month to halt the slide in tonnage.

Kwinana South

Crops in the region have held up well from the dry September up until now, but in the last few days moisture stress has started to show up. Crops are generally well grown from the regular rainfall and warm winter growing conditions, but this is going to work against them if it stays dry. The extra bulk they are carrying requires more moisture and with sub-soil moisture levels low, they will start to crash very quickly once that is exhausted. The wheat crops in particular could shed a lot of the current potential if there are no further decent falls of rain.

Kwinana North East

The majority of the cropped area in the region is wheat, with many growers dropping canola from their programs as the start to the season was pushed back. The June break to the season has resulted most wheat paddocks being later than preferred, even though they did accelerate their development during the warm winter. Many growers have been commenting that “they are too green” for this time of the year. The later flowering has coincided with a ramping up in temperature and no finishing rain, and the “green” is now being washed out of them as they come under moisture stress. The average to above average potential grain yield is now slipping away with every new day without rain.

The large area of fallow in 2023 in the low rainfall regions of the state has mostly been planted to wheat and these crops are holding up better than wheat that is not on fallow. Even so, all crops are going to continue to lose potential grain yield if the current warm and dry conditions continue.

Albany Zone

Albany West

Until a week ago, the region was one rain away from being one of the best years on record. The lack of rain in September is now starting to show with canola dropping the last of its flowers and the cereals are just starting to show the early signs of moisture stress. The region was able to get crops away early and with the lack of waterlogging and frost, the crops were in excellent shape from fence to fence. Crops had bulked up well and growers were fertilising for maximum yields. Now with no rain on the horizon, the hightop end yields are unlikely to eventuate.

Barley crops in the region still look solid and most are well into grain-fill. Wheat and canola yields could still end up around average as the region has more time for the rain to arrive, but time is running out. The swing in tonnage for the region could be huge because while the potential is still high, the absence of further rain could drop yields by tonnes rather than kilograms per hectare.

Total tonnes for the region are going to be hampered by the below average condition of the crops east of the Albany Highway, where rainfall totals drop off dramatically and consequently so does crop grain yield potential.

Albany South

The normally “safe” regions close to the coast are on a knife edge. Rainfall has been light and sporadic all year and the hot winds the region has been receiving lately has not helped. The crops are more advanced this year than normal and while the region usually has a longer window to finish crops, they are under pressure now. Without rain in the next two weeks, the drop in potential that is starting to show up now will continue at an accelerated rate.

The barley appears less impacted than the wheat, which has already lost tillers and grain-fill sites in the heads. The canola crops are not as well grown as normal and don’t have the depth of pods to hit top end yields, even if it does rain.

Albany East (Lakes Region)

Barley in the region is filling well and benefited from the rain in the first week of September. The timing of this rain was perfect for the barley’s current growth stage and most will now have average or above average grain yield potential.

The wheat is later than normal and some crops are still flowering. Most wheat crops will need a rain during the grain-fill period to reach average yields. Powdery mildew has been prevalent in susceptible varieties this year and is still present, which may also have some impact on final grain yield.

The canola crops that were able to emerge on early moisture with even germinations will have average to just below average grain yield potential, although most are quite late and will be below average irrespective of what happens from now on.

Esperance Zone

The majority of the region has had below average rainfall all year except for a stretch of country close to the coast on the west side of Esperance town, around Munglinup. The area to the west of Esperance and some areas around Salmon Gums have been better than the area to the east of Esperance all year, and this is still the case. The crops had potential to improve if there was a good spring but hopes of this are now fading. The warm persistent wind is starting to bite and time is running out for crops to recover lost potential.

Most crops are simply too late and needed a good finish to the season to hit average grain yields. As this is unlikely to be the case now, total tonnage for the zone is going to be in the 2.5 million tonne range rather than 3 million plus as it has been for the last five years.