The 2023 Season - Final Wrap-up

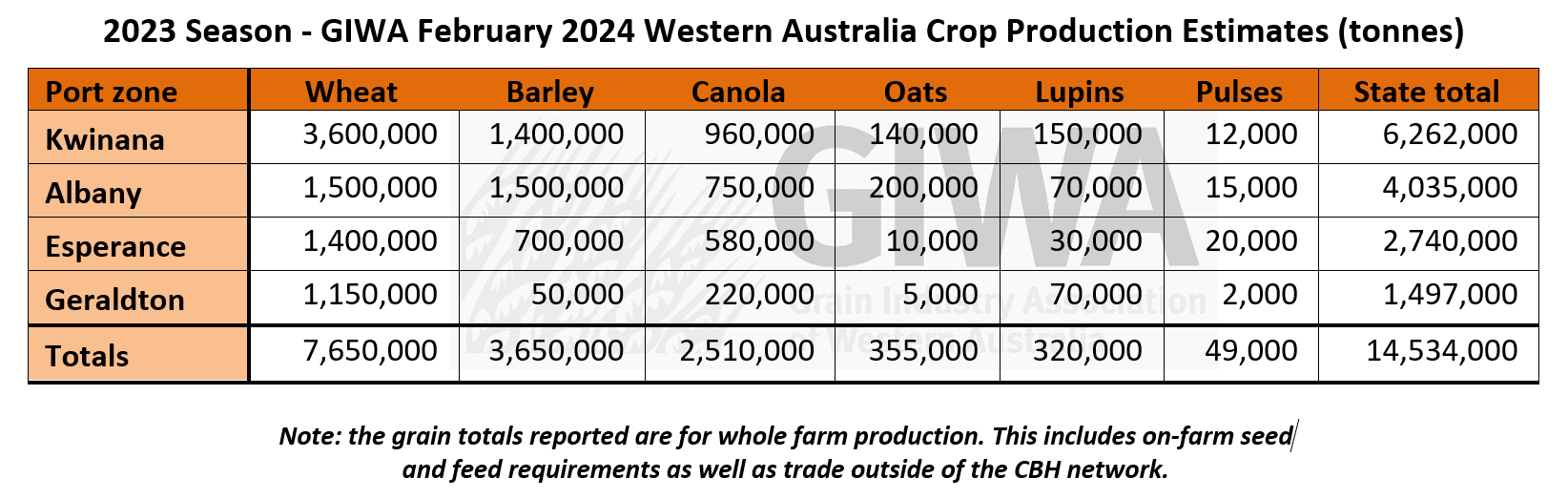

The total grain production in the 2023 Season in Western Australia of 14.5 million tonnes was nearly 50 per cent lower than the record years of 2022 and 2021. For many growers, total rainfall received in 2023 was well down on 2019 rainfall, when 11.3 million tonnes was produced on a similar area of crop sown. Subtle improvements in production systems are tending to buffer the downside of these poor years and push grain yields well beyond previous records in good seasons. The 5-year average (2019-23) Western Australian grain production is 18 million tonnes, and the previous 5-year average (2014-18) is 3 million tonnes less at 15.2 million tonnes. Whilst there is more area of crop being sown now than 10 years ago, the increased variability of rainfall events has forced growers to change their production systems to adapt to the changing weather patterns, and this is clearly showing up in the production figures. Grain production in Western Australia is still on a linear trajectory upwards despite increased variability in a drying, warming climate. Livestock production has flat lined over the same period.

The contrast between 2022 and 2023 could not have been starker. In 2022 about 3 per cent of wheat deliveries were high protein that made hard grades of one sort or another, whereas in 2023 47 per cent made hard – a reflection of the tough growing conditions and blunt finish. In years like this you would normally expect a high proportion of cereal production to fall out of the higher grades due to screenings, although in 2023 only 18 per cent of wheat fell into utility or feed grades due to high screenings. Whilst seed size was generally small, screenings didn’t blow out as much as was expected. As a result, overall grain quality was very good and enabled growers to make up some ground in dollar returns in a lower production year.

Crop area in recent years has been around 9 million hectares. There was just under 8.5 million hectares of crop sown in 2023, down from 2022 due to the lack of sub-soil moisture in many regions heading into the season, a late break and a below average outlook for rainfall. The ongoing dramas with the live sheep export trade are certainly going to have an influence on driving crop area up in 2024 in the regions where sheep are still prevalent. Less sheep will require less pasture, with this pasture area being substituted for crops. If the very dry and hot summer continues, a reduction in crop area will be seen in the lower rainfall areas of the state as more country is turned over to fallow, reducing the crop area in these regions where most of the reduction in area from 2022 to 2023 occurred.

Many growers in the north and eastern parts of the state lost some of the gains in 2023 that were made in the 2021 and 2022 growing seasons, and budgets for them are tight heading into 2024. Unless autumn rainfall is significant, a contraction back to wheat from crops such as canola which have higher input costs is likely right across the state. Good autumn rains are needed to minimise the risk of not achieving breakeven canola yields. Canola area was just under 1.9 million hectares in 2023, down 14 percent on the area planted in 2022. Canola has been the “go to” crop in recent years, although with growers maintaining a more risk adverse approach heading into 2024, it is unlikely area will go up unless there is good sub-soil moisture and an early general break to the season.

Barley performed well in 2023, whereas the quick finish to the season did not allow the wheat crops to fill their potential. The newer barley varieties have more robust disease packages and require less reliance on fungicides, particularly in the higher rainfall regions, which was in part driving down area planted. This looks to have stabilised, and barley is back in favour in most of the southern regions of the state.

There are unlikely to be wholescale changes to cropping plans in 2024, although if the dry, hot conditions continue, area planted and input costs will be pared back.

Sub-soil moisture levels are very low in most regions, and there have been record maximum temperatures in January and the start of February that have burnt off the few weeds that did germinate in some of the areas that had the storms in January. There are no summer weeds worth speaking of and no reason to get out in the paddocks other than for deep ripping and lime spreading. The plans in place for most growers are “more of the same” as most do not change dramatically from year to year. The next two and a half months will determine the change in canola area and from then on, the wheat/barley split. This will be largely dependent on the timing of the break to the season and how much autumn rain we receive.

For the higher rainfall areas, there will be more of an enterprise shift rather than a significant change in area cropped. There may be a slight increase in cropped areas due to the current low sheep prices driving turnoff if a home can be found for the excess livestock. Barley is back in favour due to its’ relative grain yield performance compared to wheat recently, and the re-opening of the China export market. For the low rainfall areas, there will certainly be more fallow on the heavy country, unless there is significant autumn rain to top up the soil moisture profiles.

The canola area could swing with a drop back to around 1.5 million hectares from 1.87 million hectares in 2023 if there is a late break, to over 2.0 million hectares if conditions are favourable at optimum planting times. Although the continuing slide in canola prices will put a cap on the area sown to some degree, and even with good early rains it is unlikely we will see a return to the record areas planted in 2022.

The lupin area is unlikely to increase significantly in 2024 even at the current high prices. Lupin area in 2023 was down to about 4.9 per cent of the total crop area sown in the state. The majority of the lupin area is no longer within the Geraldton port zone. Last year, the area in the Geraldton port zone sown to lupins dropped from being 32 per cent of the state’s total lupin area to 25 per cent due to the very dry conditions at seeding time. Whilst this will likely go back up with a good start to the season, that isn’t going to change the statewide picture much because in the remainder of the state, lupins comprise only a small percentage of the rotation on soil types that suit them, and plantings are influenced by reasons other than price.

Oats are still a minor crop and accounted for only 2.3 per cent of the cropped area in 2023. Some growers who currently grow oats may increase the area sown due to the current high prices offered. Although even with the sustained increasing demand for milling grade oats, the grain yield differential with other cereals and risk of hitting milling grade will not see a big swing into oats for grain. The oat grain/hay swap area is also unlikely to alter greatly as many growers exited the hay game recently when markets collapsed and are unlikely to return overnight.

The outlook for a change in pulse area is subdued again for another year. The combined total of all field pea, faba bean, lentil and chickpea hectares in Western Australia last year was less than 1 per cent of the total crop area and whilst growers continue to dabble, erratic prices and limited marketing options continue to be more of a deterrent than the obvious benefits to the rotation.

Seasonal Outlook

Ian Foster, Department of Primary Industries and Regional Development

Climate summary

Seasonal climate February 2024

Rainfall

November to January rain was mixed across southern WA, with some severe thunderstorms in the cropping area that damaged power infrastructure, while the west coast and southwest remained dry.

Forecast

The El Nino event in the Pacific Ocean has passed its peak and is expected to decay through autumn 2024. The positive Indian Ocean Dipole event in the tropical Indian Ocean has finished, with neutral conditions prevailing in the tropical Indian Ocean

There have been no tropical cyclones approaching the north of WA thus far during the northern wet season. BoM’s seasonal outlook is for fewer tropical cyclones than normal for the 2023-24 season.

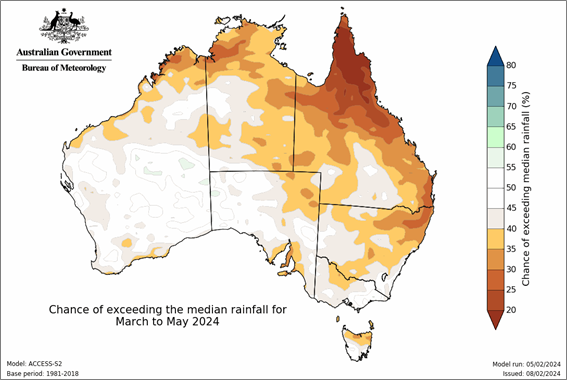

The Bureau of Meteorology seasonal outlook for March to May 2024 indicates neutral rain chances over much of WA, see Figure 1. This means the BoM climate model has no preference towards either wetter or drier conditions. Many of the international climate models also have a neutral rainfall outlook.

Temperature

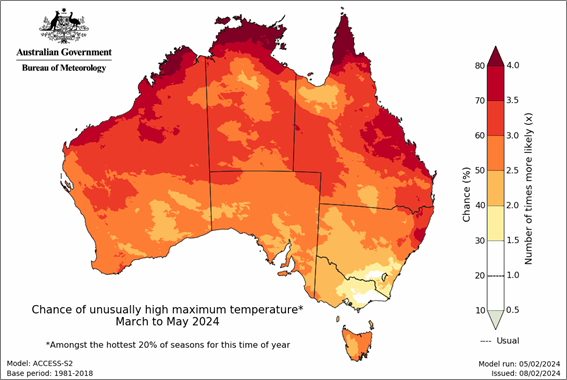

Seasonal temperatures over summer thus far have been very much above normal.

Predictions of above normal temperatures continue into autumn. Chances of unusually high maximum temperatures are around twice as likely for most of southern WA, see Figure 2. Minimum temperatures are also expected to be much warmer than normal.

Additional information is available from:

BoM: Decile rainfall for November 2023 to January 2024

BoM: Rainfall outlook for the next week

BoM: Seasonal Rainfall Outlook

Geraldton Zone

The Geraldton port zone had a stinker of a year in 2023 and whilst many growers went into the season with a consciously risk adverse approach, many if not all ended up with a negative result. Even though variable costs were generally lower than 2022, the increase in fixed costs from machinery repayments, parts and labour counteracted this. These higher cost structures will again drive a risk adverse approach for the 2024 season. In saying that, these growers are still sticking to the plan with soil amelioration and liming as this has been a proven winner in any season.

Even though grain yields were well below average for most, considering the rainfall that was received many were happy with the end result. 2023 was one of the lowest effective rainfall years on record with little sub-soil moisture reserves, and for the region to produce over 1 million tonnes of wheat is an incredible result.

It has been a very hot, dry summer to date with growers not able to get out in the paddocks recently due to vehicle movement bans and the risk of fires, and this current pattern does not look like changing. The prediction of above average maximum temperatures is definitely playing out with no change in sight.

Over the majority of the grain belt, crop area mix will be determined by how much autumn rain falls and the timing of the break to the season. The region grew very few lupins in 2023 and the recent increase in barley area will probably be put on hold as barley did not handle the 2023 seasonal conditions well at all.

Kwinana Zone

Kwinana North Midlands

The Midlands had a very mixed year with a distinct line where the rainfall dropped off east of Miling. Areas to the west ended up okay, with the generally low yields offset by increased prices due to hitting the higher grades of both wheat and barley. The eastern portions of the zone were very poor with grain yields well below long term averages.

Many budgets in the eastern areas are lineball on current grain prices and longer-term average grain yields. It is not going to take too much of a hiccup to push profit negative. Growers are very aware of this and have several contingency plans in place depending on the timing of the break to the season. We are probably unlikely to see whole-scale large areas of dry sowing as in the past due to the risk involved. In the western areas the situation is quite different as these growers returned closer to average grain yields in 2023 and benefited from less waterlogging and leaching rains than normal. Most are sticking to the longer-term rotations with a high percentage of canola in rotation with wheat or barley. Oat hay area may increase slightly, and the option to not drop oats for hay depending on the season may result in an increased area of milling oats. The lupin area is unlikely to change too much from 2023.

The region was historically a major malt barley growing region and the high percentage of barley hitting malt grades in 2022 and 2023 has reversed the tendency for increased substitution from barley to wheat that was occurring.

Kwinana South

Areas of the region that started out with decile 9 rainfall slid to decile 4-6 by the end of the season, and the areas that were decile 4-6 at the start of the season slid to less than 4. As a result, the areas that were looking very good in May contracted back to isolated regions around Brookton, Quairading and to south of the Great Eastern Highway around Cunderdin. All regions had a hot dry finish and without the 12-15mm rainfall event in mid-September, the final tonnages would have been much lower than what was eventually harvested. The good areas of the zone had up to 400mm of rain, whilst the remainder of the zone finished up with 230mm or less.

For most growers, the timing of the start to the season and when growers were able to sow and get crops up had the greatest impact in final grain yields. It was back to an old-fashioned scratchy start with staggered intermittent rainfall with warm temperatures in between that dried out the surface profile and restricted the available sowing days following the rain. The hot dry finish effectively then compacted the season, limiting the ability of crops to reach the potential that was built up in the growing season.

Grain quality was generally better than expected with reasonable protein levels and lowish screenings. Only about 5 percent of deliveries in the combined Kwinana zones fell back into Utility grades with the remainder making the premium or lower protein premium grades. Cereal crops ended up accumulating protein in a restricted number of grain sites in the heads, and those that missed the heat at critical growth stages managed to fill the heads with good size grain.

Looking to 2024, growers are going to be flexible in targeting canola paddocks based on the timing of the break and available sub-soil moisture. Most draw a line in the sand and swap out of canola and to a lesser extent lupins at a certain date based on expected yield and projected price. The better canola growers can yield 50-60 per cent of wheat yields and at current prices around $650/tonne, canola is still an attractive option, although the breakeven point slides very quickly as the sowing date gets pushed back. Even though growers are currently projecting little change in area from 2023, the matrix of price, timing of rainfall events and the moisture profile will determine the final area planted.

Oat hay area may be up slightly due to the opening up of market choices recently and the improvement in price, although any increase will likely be due to existing hay growers upping their sown area, rather than new growers moving into oat hay production. Lupins are in the same boat and will only increase in area from existing growers.

Kwinana North East

Rainfall in the low rainfall regions of Kwinana fell away dramatically in the spring with many regions receiving no effective rainfall after July. Cereal crops had built potential particularly in the East Kwinana following autumn rains that provided some sub-soil reserves and early planting opportunities, although crops sweated off tillers and fell back to below long-term averages in many cases. Return per hectare was boosted by higher prices, with many growers delivering into the higher protein grades. Interestingly, there was more premium hard wheat produced than premium white grades.

Canola suffered from the lack of spring rain and many crops returned grain yields in the 500kg/ha range, pushing margins negative. This region of the state was a major contributor in area of canola planted in 2023, and the poor result last year for many combined with absolutely no sub-soil moisture at the moment, will see many paddocks in current plans shift to fallow or back to wheat if decent falls of rain are not received prior to the end of April.

As reported previously, cereal yields on paddocks that were in fallow in 2022 were well in front of most paddocks that were cereal-on-cereal as you would expect, and coming off the back of a poor season, strategic fallow will be in the mix for a lot of the heavy country in 2024.

Albany Zone

Albany West

The run of exceptional years in the region came to a bit of a halt in 2023 with all crops back to more long-term averages of 2.0t/ha for canola and high 3.0t/ha to low 4.0t/ha for wheat and barley. At these yield levels, they are still profitable although the breakeven yields are now closer to 1.7t/ha for canola and 3.2-3.7t/ha for cereals which sounds high for growers in other regions of the state and for the rainfall seemingly achievable. Although a return to a greater influence from waterlogging and frost can see these average yields across whole paddocks quickly slip below profitable levels.

As a consequence, whilst grower sentiment is still very high for the region, there is a noticeable return to careful spending on input costs and less appetite to push for very high yields in all situations. Fixed costs have been the big mover for most growers particularly for machinery, machinery parts, transport and interest if there have been recent financed land purchases. This will not go away and whilst the recent drop in variable input costs has been a good thing, the costs of growing a crop in these high rainfall regions is putting the pressure on to keep the yields up.

Enterprise mix is unlikely to change dramatically in 2024. There will be a slight shift back to barley as whilst Maximus has not been yielding as high as Planet, it is less expensive to grow. There was only around 15-20 per cent of barley that went malt, although this is more than in recent years when virtually all barley went feed. More of the wheat went noodle than in the past as well, and whist it is still a minor grade in the region, the gradual move into longer season noodle varieties will probably continue.

Albany South

Most growers ended up the year in front without being exceptional as has been the case in recent years. There is more tempered optimism going into the 2024 growing season as the cost of growing crops in the high rainfall regions has climbed to a point where it is putting pressure on growers to keep hitting the more recent higher average yields more often. Achieving the lower long term average yields is no longer profitable for many.

The region finished up with canola being the standout crop in 2023. Whilst canola crops did not yield as high as they looked with those looking like 2.5t/ha actually yielding closer to 1.8 to 2.0t/ha, due to the strong price, most returned a profit. Oil percentages were in the low to mid 40’s rather than the high 40’s in 2021 and 2022 which reduced price premiums to growers. Most growers in the region have the agronomy of growing canola well in hand and whilst overall costs of growing canola have increased from 2023, the slight drop in variable costs will mean plenty of canola will be grown in the region again in 2024.

Barley grain yields fell away with the later plantings away from the coast. Wheat also suffered from the disjointed season where crops had to contend with later and difficult conditions at germination, followed by very wet, cold growing conditions in winter, and a short sharp spring where the rain cut out and the heat came on very early for the region.

The enterprise mix for the region will probably remain similar to 2023, with a possible slight shift to more barley as growers have mostly moved out of Planet barley for the newer more disease tolerant varieties that still have relatively good top end yield potential.

Albany East (Lakes Region)

It was a below average rainfall year for the Lakes region and whilst grain yields were well below the last few years, most growers were happy with the result considering the rain that fell. The main take away from 2023 was the difference in the grain yields from time to emergence for all crops. 2023 was a year where making the most of early sowing opportunities carried through for the whole year and the difference in final grain yield was substantial. It was “the year of timing” and a reminder of the importance of the impact of lengthening the growing season. Growers that received the early rain and had follow up “rain trains” were well in front of those that sowed later, and this year most of the discussion has been around being ready to go and making the most of early sowing opportunities. The importance of timing has been cemented in the brain following several forgiving years’ previously.

Looking towards 2024, most growers are wanting to reduce sheep numbers although they are unable to get rid of them, and whilst many are planning to join less ewes, this will not have an impact on sown area until the following year. It is therefore unlikely in this region that the crop area will go up significantly in 2024.

The soil moisture profile is currently very dry, and the majority of the planned canola and oat area will be considered “swinging paddocks” with the timing of the break and autumn rain determining the outcome. Sub-soil moisture levels improve in the southern regions closer to the coast, and these areas will be less impacted by these factors.

There is going to be a big move to hybrid canola from less vigorous open pollenated (OP) varieties. The foraging ability of the new hybrids is substantially better than the OP varieties. This has been known for a very long time but 2023 highlighted to growers how much better hybrid varieties can be in a tough year.

Esperance Zone

The Esperance Port Zone had a very mixed year as reported previously, and the final wrap reinforced this. Around half the wheat delivered went to hard grades of one description or another, which is previously unheard of and is a reflection of the tough finish to the season. In sharp contrast, the regions around Beaumont had their best year ever.

Barley crops in general yielded well in 2023 and the shift out of barley in favour of wheat that was occurring will probably reverse a little. Hybrid canola was well in front of the non-hybrid varieties by a fair margin in 2023 and the split in area planted is projected to be about 50/50 in 2024. The difficulty experienced in getting the weed control timings within “safe” windows with the triazine tolerant (TT) varieties is in part facilitating the move away from the non-hybrid and hybrid TT varieties, as is the success of the Podguard trait which has decreased the requirement to swath to limit shattering.

The “average” year in 2023 for the region has growers looking closely at costs and breakeven points for all crops more closely than in the past. The “spend-up” not just in Esperance but all regions in recent years has pushed fixed costs up to a point where it is putting pressure on growers to achieve higher average grain yields year-in, year-out.

Pulse crops have gone off the boil in recent years due to price and market options and this may reverse a little in 2024 as there seems to be renewed interest in lentils and faba beans.