The 2022 Season - Final Wrap-up

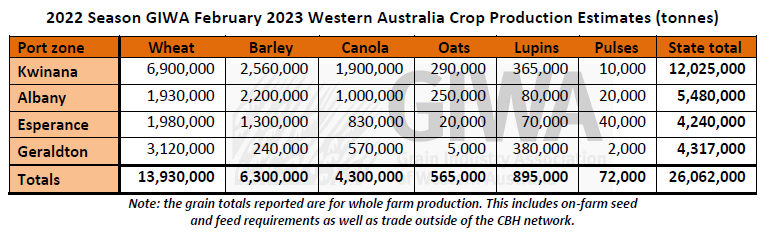

The total grain production in the 2022 Season in Western Australia of just over 26 million tonnes is 8 per cent higher than 2021 and 31 per cent higher than 2016, the previous record year up until 2021. Western Australia has produced just over 50 million tonnes of grain in the last two years compared to about 60 million tonnes in the previous 4 years. This includes the previous record production tonnages of 18.2 million tonnes in 2016 and 17.9 million tonnes in 2018. The total tonnes produced by Western Australian growers in 2022 equates to about two years of average production 10 years ago. That is an incredible result and one that may not be repeated for a while.

The exceptional result was due to a near record area sown of 8.9 million hectares, slightly down on 2021, 7 per cent more than 2020 and 16 per cent more than previous record years. The season started with good sub-soil moisture across the state, an early start to planting, warm growing conditions to set up very high yield potential for all crops, followed by very mild conditions and very little frost during grain fill. This combination of factors rarely occurs over such a wide area of the state.

As a result of the two good years in a row, many grower’s balance sheets are strong with low levels of debt, good cash reserves and recent capital upgrades. Along with this though, fixed costs have increased substantially, and many growers are now locked into higher production cost structures.

Even though variable costs have come down a little, the pressure is now on for many to exceed 5-year average paddock yield levels to break even.

So, the question growers and their advisors have been pondering is, “what to do in 2023”?

Sub-soil moisture levels are good for central and southern regions of the state although the recent climate prognosis is shifting rapidly back to a more “normal” scenario of less rainfall for the 2023 growing season. For many growers in the lower rainfall regions, there will be a pulling back in area cropped. This will be largely dependent on the timing of the break to the season.

For the higher rainfall areas there be will more of an enterprise shift rather than a significant change in area cropped. There may even be a slight increase in cropped area due to the current low sheep prices. Barley is clearly out of favor due to its’ relative grain yield performance compared to wheat recently, and the high cost of controlling diseases in the higher rainfall regions. Wheat has outperformed barley in yield for the last few years’ due to the mild slow finishes making better use of available rainfall and probably less frost taking the top off the average yields that occur in most years.

Canola area could see a swing back to well under the record 2 million hectares grown in 2022 if there is no autumn rain and a late break. Lupin area is under more pressure now the price of bagged nitrogen has come back a little and there are significant volumes of lupins being carried over on farms. Oats are still a minor crop accounting for less than 3 per cent of the cropped area in 2022, however even though the outlook for hay is still a bit subdued, the recent advances in milling grain marketing will probably see the area creep up a bit. Pulses are having a tough time on the price front and whilst everyone would like to grow more, the dollars simply do not stack up for many growers. In saying that, cereals following lupins, legume pasture and pulses in 2022 returned up to 2 per cent higher protein at higher grain yields and less applied nitrogen than cereal on cereal paddocks.

Highlights from 2022, apart from the exceptional total production, were the very good average yields of canola across the state. Producing 4.3 million tonnes from just under 2.2 million hectares is incredible when one considers at least a quarter of that production was in the low rainfall regions with many growers having grown nil or little canola recently. Western Australia planted 51 per cent of the nation’s canola area and grew 56 per cent of the total tonnes.

Lupins were also exceptional with grain yields of 4 tonnes recorded for the first time. Lupin grain yields have been creeping up in recent times and whilst the price per tonne is low, growers are sticking with them as they are the only serious legume option other than pasture. Interestingly, lupins are now viewed as more of a low cost “light land fallow crop” rather than a traditional break crop. The subtle difference being, whilst growers are persevering with lupins for the break crop benefit, they are growing them “on the cheap” happy to break-even for their future benefit to the more profitable following crops, similar to heavy land fallow.

Wheat grain yields were also a highlight, and this has continued to fuel the recent move out of barley for wheat across the state. It will be interesting to see if this continues if we have a run of tight finishes in coming seasons.

Seasonal Outlook

Ian Foster, Department of Primary Industries and Regional Development

Climate Summary

Dry conditions have prevailed over most of the agricultural area for summer to date, with some locations receiving heavier falls due to thunderstorms. Daytime temperatures have been above normal away from the South Coast, although with fewer extremes. Strong high-pressure systems have generated persistent easterly winds, with fewer west coast heat troughs. Last year, summer was similarly dry but much hotter in the west.

There has been little rain in February to date, and while the end of the month may see some rain, monthly total rain is likely to remain below normal. Soil water storage is generally low for shallow depths, but according to DPIRD soil moisture probes, water remains at depth. March rain outlook is neutral (meaning no preference towards either wetter or drier), but March is a traditionally dry month anyway.

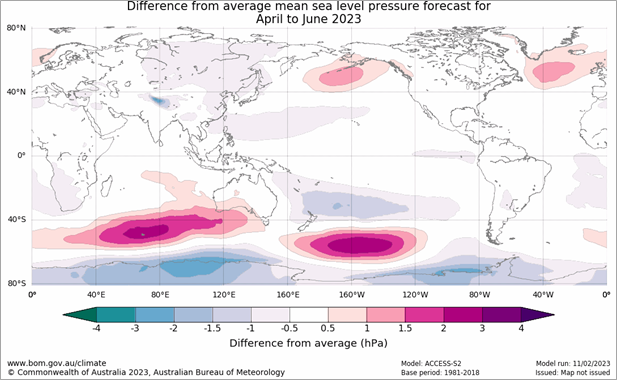

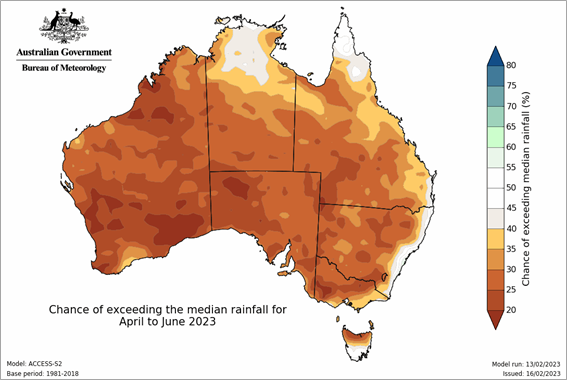

Beyond that, climate models are indicating below normal rain is more likely from April to June. There is strong agreement among models for this. This is different from the outlooks for the same time in 2022. Predicted atmospheric pressure patterns show higher pressure south of WA (Figure 1), which is a plausible driver for lower rainfall over southern WA at that time. Figure 2 shows the rainfall outlook for April to June 2023 from Bureau of Meteorology.

Climate models are also predicting development of an El Nino event in the Pacific Ocean, and a positive Indian Ocean Dipole event in the Indian Ocean from June onwards. Combined impact from concurrent events is to suppress rainfall over Southwest WA, as well as over much of Australia. Predictive skill for these events from late summer is historically low, so it is necessary to monitor seasonal climate as it unfolds.

The start to the 2023 growing season is likely to be different from last year, which had above average rain over March and April. Possible implications are patchy sowing and crop emergence opportunities, with soils that are dry at seeding depth.

Additional information is available from:

DPIRD: Seasonal Climate Information

BoM: Decile rainfall for January to December 2022 to January 2023

BoM: Rainfall outlook for the next week

BoM: Seasonal Rainfall Outlook

Figure 1. Predicted sea level pressure anomalies over April to June 2023, based on model run 11 Feb 2023. From Bureau of Meteorology.

Figure 2. Chances of exceeding median rain for April to June 2023, based on model run 13 Feb 2023. From Bureau of Meteorology.

Geraldton Zone

The Geraldton port zone has produced just over 4 million tonnes of grain for the last two years. Prior to 2021, the previous record was around 3.6 million tonnes. Two record years in a row is rare and some growers in the eastern corridor have had three good seasons in a row, which is unheard of. Four good years in a row has never happened before and this has led to a more risk adverse approach by growers to the 2023 cropping season, particularly leading up to Christmas. Although the recent reduction in variable costs such as fertiliser and crop protection products has changed the thinking to “risk adverse while keeping options open and ready to react”, it still depends on what unfolds at the start of the season.

Unlike further south in the state, the soil moisture reserves are currently low and this will almost certainly mean more fallow on the heavy soils that are able to store moisture. The area of fallow has been low in the last few years as growers have opted to crop those paddocks targeted for fallow and take the cash instead of leaving them out. Advancements in managing fallow at a lower cost and the contribution of mineralised nitrogen on fallow paddocks being able to supply 50 per cent of the following crops’ needs, will see less crop area in 2023 for the zone. The lighter soils that do not store moisture will continue to be “fallowed” with lupins even though they may not contribute significantly to the profitability of whole farm operation. 2022 was an exception to this and due to the very high grain yields, despite low prices, lupins were profitable in the year they were grown, which is not always the case.

Kwinana Zone

Kwinana North Midlands

The Midlands had a year to remember from west to east. The recent drop in the cost base of growing a crop has changed paddock plans made during and at the end of harvest to one of more confidence rather than pulling right back. In saying that, there is continued nervousness as budgets are line-ball on current grain prices and longer-term average grain yields. It is not going to take too much of a hiccup to push profit negative. Growers are very aware of this and have several contingency plans in place depending on the timing of the break to the season. We are probably unlikely to see whole-scale large areas of dry sowing as in the past due to the risk involved.

The region was historically a major malt barley growing region and this has fallen away to make room for more wheat and canola with the dominate rotation being wheat/canola/wheat in the medium and high rainfall areas rather than barley on barley or wheat/barley/canola as in the past. Lupin area will probably reduce due to the poor price and a lot in store. Lupins are increasingly treated as light land fallow managed with low input costs for the benefit of the future nitrogen.

There doesn’t seem to be any move back to oat hay at the moment, with those paddocks continuing to be substituted for canola.

There was a lot of ASW and AWS9 produced in the region last year as there was across the state and for many growers, several paddocks fell off the “protein cliff” into the lower grades. This progression from APW to the lower protein grades has accelerated in the last two very high production years and points to where it may head longer term as yields continue to go up. Growers in the lower rainfall regions of the zone will most likely move back to more fallow for yield security and cheaper nitrogen.

Kwinana South

The higher rainfall regions of the Kwinana zone had a very good year. There were a lot of whole paddock averages for wheat, barley and canola, well above long term averages. This graduated to the best ever the further west you went in the zone.

Weeds, particularly ryegrass, got away in a lot of paddocks with the very slow, soft finish and growers that had seed destructors fitted to their headers went over every centimetre right on the “deck” to pick up everything they could. This made for slow going at harvest although it will surely pay off in 2023, not only in weed management, but also in the ability to sow though the very thick stubble.

Kwinana North East

The low rainfall regions of Kwinana produced more grain than the higher rainfall Kwinana west area for the first time since the zones have been split up. A very good result for those growers, and particularly for those that were hammered by frost in 2021. Grain protein was low, as expected, although the other aspects of grain quality such as grain weight were excellent.

There are reasonable levels of stored soil moisture right throughout the low rainfall regions of the zone, and this could prove to be very valuable if the low rainfall outlook for the growing season eventuates. There was a massive increase in canola area in the zone of several hundred thousand hectares that will evaporate if no top-up autumn rain is received and there is a late break.

The area of crop was historically high last year and whilst there is sub-soil moisture to work with, many of the far-east and far-north growers will probably swing country back to fallow, to provide security of income in future years.

Albany Zone

Albany West

The West Albany region has had a run of very good years and the success from the move towards more early sowing has been paying off when waterlogging inevitability cranks up in the winter. Consequently, growers are well into planning ready for action in 2023. The area has sub-soil moisture carryover from 2022 and it will not take much rain to get the profile saturated.

Wheat was brilliant in 2022 in the region, has outyielded barley in the last few years, and similar to other regions of the state, there will be a continued shift out of barley to wheat again in 2023. It is looking like the dominant cropping rotation will be canola/wheat rather than canola/barley this year. There is still some grain on farm from harvest, although this is mostly lupins and beans and growers are waiting for higher prices before moving them.

Even though the cost to grow a crop in the region is now over $1,000/tonne, there will probably be a slight shift to more area cropped as sheep are difficult to get rid of at the moment, with no sign in the near future that the situation of tight processing and lack of export markets for aged sheep will improve.

Fixed costs have been the big mover for most growers particularly for machinery, machinery parts, transport and interest if there have been recent financed land purchases. This will not go away and whilst the recent drop in variable input costs has been a good thing, the costs of growing a crop in these high rainfall regions is putting the pressure on to keep the yields up.

Albany South

Growers in the region eventually managed to get over the wet portions of paddocks and finish harvest in January, although plenty of grain was left behind with up to half a tonne of barley on the ground from wind, hail and heavy rainfall and at least 200kg/ha of canola lost in the same manner. Final harvested grain yields were still very good and above average in most cases.

There looks like there will be a swing back into pasture in these higher rainfall regions of the state at the expense of lupins and beans due to the low feed grain prices. There also looks to be a continued awing out of barley to wheat particularly where barley was grown two years in a row. Canola/wheat/canola has been more profitable as the second-year barley has been costly to grow. Barley grain yields were down on wheat in 2022 and in some cases where there was difficulty in controlling net type net blotch and powdery mildew, the yields were grossly different.

A lot of the grain in the region had high levels of snails and ergot and was moved to specialist markets west in the zone.

Albany East (Lakes Region)

The region had the “best ever” season in 2022 and like growers in other regions of the state, most don’t expect it to be the same this year. The lack of frost in the last two years has enabled crops to fully fill their potential and has demonstrated to growers what can be achieved with good rainfall and little frost to take the top off crop yields.

Canola area has crept up in the last few years and has yielded well for those growers giving it a go. Even so, the area in 2023 will be highly dependent on the timing of the break. The subtle shift away from barley to wheat will likely continue as it is across the state, which is interesting as it was only a few years ago that barley was by far the dominate cereal in the rotation.

Esperance Zone

Growers in the Esperance region are finally winding up the 2022 growing season harvest with the majority of grain bags now having been emptied for cleaning and drying. The demand for dryers and cleaning has been well in excess of supply and will continue into March, although the percentage of total production to be delivered is now low. The opening of high moisture stacks has helped in getting grain off farm and taken the pressure off growers.

Similar to the Geraldton port zone, Esperance has had back-to-back years in excess of 4 million tonnes of total grain produced. Whilst the 2023 harvest was challenging for many and has dragged out well past harvest, the end result is another exceptional year. 2022 was characterised by the whole zone being good rather than very good. All areas of the zone contributed to the result rather than having any weak spots. There were however areas that were “best ever”, such as around Cascades.

Looking forward, the Mallee areas have had a couple of good years in a row and again similar to further north in the state, many growers are planning to back off in area in 2023 thinking it will be too good to be true to expect another above average year. On top of this, there is some nervousness around the upcoming season as with anticipated grain prices and the increase in fixed costs, margins on average yields are just breakeven at the moment.

The whole zone had significant rainfall just prior to and during harvest and the available sub-soil moisture will be in the back of growers’ minds as the end of March and the start of April nears. They will be ready to jump onto any planting opportunity following a rainfall event.

Barley really struggled in 2022 from leaf diseases, and the soft finish again favoured wheat over barley with wheat paddocks regularly outyielding barley. Some of this may be due to barley being treated as the “poor cousin” to wheat. Whatever the case, there will probably continue to be a swing out of barley to wheat in 2023.

There are plenty of pulses stored on-farm waiting for prices to improve. Growers are planning to lengthen out pulses in the rotation rather than grow more.