The 2021 West Australian Grain Season in Review – An Extraordinary Season!

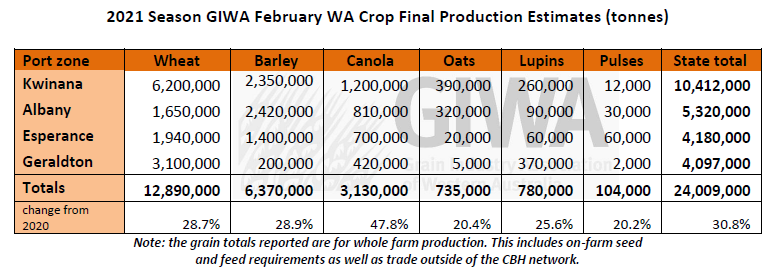

The total grain production in Western Australia of just over 24 million tonnes for all grains is more than 30 per cent higher than previous record years. The exceptional result was due to a record area sown of 9.2 million hectares (7.8 per cent more than 2020 and 16 per cent more than previous record years), good subsoil moisture across the state, an early start to planting, warm growing conditions and higher than average fertilizer usage in the winter to set up very high yield potential for all crops, followed by very mild conditions during grain fill. This combination of factors rarely occurs over such a wide area as it did in the 2021 season.

Western Australia still produced over 38 per cent of Australia’s grain in a year when all of the eastern states with the exception of South Australia, harvested record or near-record crops. The national total was a record 62 million tonnes for all grains.

The year was not without its’ challenges, and the severe frosts in September wiped out at least 2 million tonnes of grain in the central grainbelt. Many growers in this region only just made a profit, which was heartbreaking considering how good things looked up until the frosts hit. There was also severe waterlogging over large areas in the south and western rim of the grainbelt. However, the incredibly mild finish allowed these areas to recover to an extent that could not have been imagined at the start of spring.

Looking ahead to the 2022 growing season, the cost of putting a crop in has gone up substantially, primarily due to high fertiliser and herbicide prices due to supply constraints, and this will result in less area sown and subtle swaps in crop types. There will be more fallow in the low rainfall regions unless there is another exceptional start, and more canola will be planted in the medium and high rainfall zones. The total area sown to crop in the low rainfall zones will be strongly driven by the amount and timing of rainfall in April and May. Barley will be swapped out for wheat in the higher rainfall zones due to the current lack of upside potential to price compared to wheat. There will be more crop and pasture legumes sown to provide nitrogen for 2023 sown crops. Oat area will probably remain static as even though sown area was down a lot in 2021, there was more grain produced than in previous years.

The western and south coast regions of the state have subsoil reserves of moisture whilst the low rainfall zones are completely dry. The next few months will have a big impact on the size of the 2022 crop area.

Seasonal Outlook

Ian Foster, Department of Primary Industries and Regional Development

Climate Summary

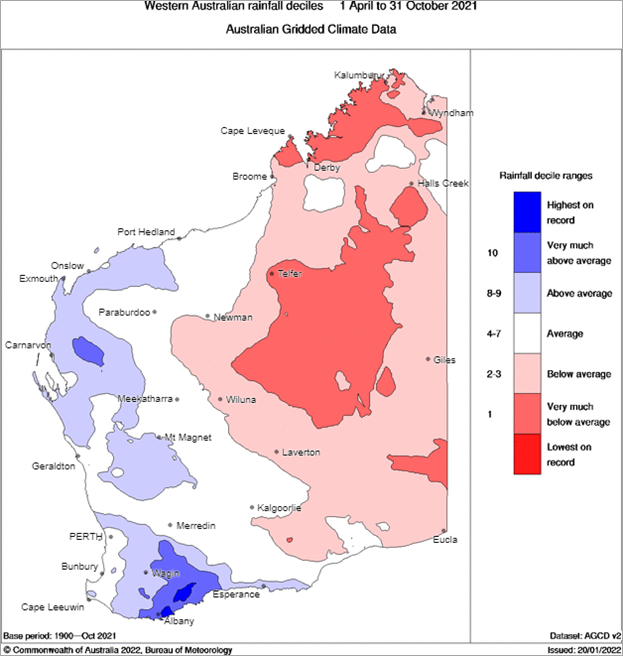

Growing season rainfall in 2021 was above average for most of the agricultural area, especially in the south, see Figure 1. The rainfall pattern was favourable for good crop production comprising early autumn sowing opportunities mostly into stored soil water and good spring rain. Heavy rain events across much of the Great Southern produced a return to waterlogging. Spring daytime temperatures were generally benign, with reduced heat impact on crops. Frosts did occur but were centred more to the north-east than usual.

Climate events in the oceans around Australia comprised a negative Indian Ocean Dipole (IOD) event in the tropical Indian Ocean and a late developing La Niña event in the Pacific. Ocean temperatures were generally warmer than average.

Most climate models have neutral rainfall outlooks for February to April 2022 for the agricultural area of WA. Daytime temperatures are expected to remain above average, retaining an increased risk of hot days.

Enhanced seasonal fire danger risk continues over southern WA, coming from increased fuel load, seasonally dry conditions, and a high chance of above normal temperatures. Lack of summer rain to date has resulted in low soil water stores.

Bureau of Meteorology seasonal outlook summary, issued 3 February 2022:

- February to April rainfall is likely to be above median for parts of eastern and central Australia, while below median rainfall is likely for parts of the central NT, coastal SA and western Tasmania.

- February to April maximum temperatures are likely to be above median for much of the west, south and north, with southern parts of the east coast likely to be below median.

- Minimum temperatures for February to April are likely to be warmer than the median Australia wide.

- The La Niña in the Pacific Ocean, and the forecast positive state of the Southern Annular Mode (SAM) are likely influencing the rainfall outlooks.

Additional information is available from:

DPIRD: Seasonal Climate Information

BoM: Seasonal Rainfall Outlook - weeks, months and seasons

BoM: Decile rainfall for November 2021 to January 2022

BoM: Landscape soil water balance

Figure1. Rainfall deciles for April to October 2021. From Bureau of Meteorology.

Geraldton Zone

2021 Season

It has been a record year for growers in the Geraldton port zone; both for yield and profit. Considering the extensive damage caused by Cyclone Seroja in early April last year, the 2021 crop was definitely what was needed for the zone. By the end of harvest everyone was exhausted and more than ready for a break.

One comment from a financier was that this has been a record year for paying down farm debt.

Growers tried to manage their nitrogen inputs to maximise yield and quality but despite applying more than ever, protein levels were still low with the majority of wheat heading to the ASW grade. There were patches of frost on the Kalannie, Dalwallinu and Morawa districts. Early sown wheat escaped damage while wheat sown at the ‘optimum’ time of mid-May suffered the most damage. Farm yield averages were still excellent.

2022 Season – looking forward

Canola was a standout crop in 2021, with the new varieties available showing more resilience and reliability in the lower rainfall districts. As a result, there will be more area sown to canola and less to lupins in 2022.

After two good seasons, the low rainfall district will look to more chemical fallow this year to reduce their risk profile and reduce weed burdens. Growers are mindful that the chances of getting a third good season in a row can’t be high, and this could amount to a drop in cropped area of around 30 per cent.

Sclerotinia remains a big yield threat in canola, particularly closer to the coast. Good management does work, however, where the timing or efficacy of fungicides was compromised, yield reductions of 0.5 to 0.7 t/ha were recorded. There are some proactive fungicides being used in lupins where the risk is understood, but more work is needed to improve this understanding. It was not unusual to hear of lupins being rejected at delivery for high sclerotinia levels.

Mice may need baiting as well, but good measurements and observations will be needed. Substantial quantities of mice baits have been purchased in preparation.

Kwinana Zone

Kwinana North Midlands

2021 Season

The mid-west region has been hot and dry since harvest with harvest concluded for most by New Year, which is as late as it has ever been. Financially it was the best year on record, but 2016 beat it for yields. This is mainly down to transient waterlogging which affected around 10 to 15 per cent of the region. Wheat recovered from the waterlogging far better than barley. Canola affected by waterlogging was sparse and difficult to harvest but was still more profitable than a reseeded crop. Lupins yielded very well but later harvested lupins lost yield from shattering due to high winds in late November.

Sclerotinia infection was high in canola and lupins, but well-timed fungicide applications controlled it well in canola.

The protein profile was low in cereals with a majority of wheat making ASW grade, APWN or Noodle grades.

Mice were no worse than in previous years. Some baiting was done in eastern districts with some being worth the effort and others not. Some growers were drawn into baiting because the neighbours were. There will be more scouting and card checking for mice this year. Along the west coast, snails are continuing to grow as a problem. Some canola grain from the region required cleaning to reduce snail contamination prior to delivery.

To date there has been some summer weed spraying, but growers are mindful of cost and availability of glyphosate and are being judicious in its use.

2022 Season – looking forward

The canola area may rise dependent on the timing of the break to the season, but many growers are ‘full’ of canola and have little scope within their rotations to sow more canola, or to bring additional paddocks into crop. The increasing risk from sclerotinia, and also now for lupins, is also a deterrent. The barley area should fall in favour of more wheat. Sheep producers will keep more numbers and increase the pasture area slightly. In eastern districts, chemical fallow is likely to be popular in paddocks with low profitability.

Overall, the cropped area will fall slightly.

Kwinana South

2021 Season

The whole region had a brilliant year with higher than average yields for all crops. Many of the larger growers were still harvesting after Christmas which is not the usual practise.

2022 Season – looking forward

One of the main challenges for 2022 will be weed control as many crops had late germinations of ryegrass that will need to be controlled with a knockdown or with pre-emergent herbicides. The high stubble loads from the high yields will need to be dealt with if they weren’t at harvest.

There is likely to be a slight move away from barley to wheat, and growers not maxed out with canola area will plant more hectares.

Growers with sheep are retaining older ewes and we will see a slight increase in sheep numbers for the first time in many years.

Kwinana North East

2021 Season

Most growers in the zone ended up with average or above average yields. Those that experienced the worst of the frost that hit the north and eastern regions fared worse and many struggled to make a profit for the year. The final wash-up was probably better than most expected considering the lack of spring rain and widespread frost.

2022 Season – looking forward

Canola was the standout crop in 2021 for profitability and whilst most growers would like to stick with the area sown in 2021, it will depend entirely on the timing of the break to the season and the amount of moisture in the subsoil.

Wheat will again be the dominant crop for the region. The area of crop will probably drop back to historical averages as little ground was left to fallow in 2021. Growers are planning to concentrate on their better set-up paddocks to keep the lid on input costs.

Albany Zone

Albany West

2021 Season

Even though it was a good year financially, most growers are happy to see the back of 2021. Waterlogging made farming difficult in the winter and those that were impacted by frost had a slow harvest.

There were big differences in grain yield between “wet” farms lower in the profile and “dry” farms higher in the landscape, with plenty of 5 to 6 t/ha barley and wheat on the dry farms graduating back to 3 to 4 t/ha on the wet farms.

Canola was exceptional in the area, as it was across the state and many growers had 2 t/ha whole farm averages.

2022 Season – looking forward

Looking ahead, there is likely to be more canola sown and a shift out of barley to wheat by up to 25 per cent. Growers are planning to sow slightly more lupins and keep more area to pasture.

There is still a reasonable tonnage of undelivered grain in the zone.

Albany South

2021 Season

Commentary for the Albany South zone for the season is very similar to the Esperance zone.

Snails and ergot posed difficult and expensive contamination problems. For snails, optimum baiting in autumn was compromised by early and persistent rain, while late maturing ryegrass was heavily infested with ergot because crop topping was made difficult as growers tried to avoid damage to late maturing tillers in the crop. Both snails and ergot required grain to be cleaned for delivery.

The decision making needed for reseeding waterlogged paddocks was difficult, particularly in the Wellstead to South Stirlings to Kendenup area. Topdressing barley seed resulted in poor establishment and weedy crops, while waiting until late August to reseed resulted in very clean and profitable crops. Despite the late sowing date, these were mostly harvested by mid-January with barley yields at 2.5 to 3 t/ha and wheat at 2 to 4.5 t/ha, a very good, but unexpected result. These were mainly sprayed-out canola paddocks which had high fertiliser applications at seeding.

Winter wheat was very successful when sown in early April, out yielding traditional spring wheat crops sown in late May. Early crops generally did much better than those sown at the usual time because they were big enough to handle the waterlogged soils far better. In this regard, faba beans were also a stand-out for yields though a lot remains unsold with limited marketing opportunities. Some summer forage crops have gone in, but they are now in need of rain to maintain any potential.

2022 Season – looking forward

There may be less faba beans grown in 2022 in the region. Canola area should be at least similar if not slightly higher. Wheat may increase in area where it performs better than barley. Those with livestock will increase their numbers and pasture area. Due to the lack of summer weeds and high rainfall in November, medium rainfall districts have good subsoil moisture. Most growers have locked in their phosphorus needs at $1,100 per tonne but not a lot of nitrogen has been bought to date.

Snail and mice baiting will be a high priority in 2022.

Albany East (Lakes Region)

2021 Season

This was the best season in the upper Great Southern and Lakes regions for yield and financial rewards. Many growers in the region say it was the best season they have ever seen.

Frustratingly, many growers applied the most nitrogen on record but still recorded low protein with wheat mainly making the ASW grade, even on paddocks with a good legume history.

The main challenge was logistics, with wet paddocks causing delays in fertiliser applications and weed control. There was Russian wheat aphid in crops but luckily little damage was seen at harvest. Blackleg in the upper canopy caused concern in canola, but there were no mice issues or sclerotinia to worry about.

A lot of canola was not desiccated for weed control to avoid substantial damage from wheel tracks. Planes were unobtainable. As a result, ryegrass seed-set was high and this will cause some issues for 2022.

2022 Season – looking forward

The overall farm programs this year will be very similar. No major changes are planned other than options to cope with a late break to the season. Some marginal paddocks may go to fallow for weed control and pasture areas may rise for those with stock. If any crop is reduced in area, it will be barley.

Because of the weed issues arising from the lack of chemical desiccation in canola last year, there may be a swing to swathing to aid harvest efficacy and weed control.

Esperance Zone

2021 Season

The Esperance region had record grain yields in 2021 along with record financial returns for the season.

Pre-harvest estimates were lower than actual yields recorded, in some cases substantially below, with growers getting a pleasant surprise once the headers went it. Frost was apparent in the mallee region of the zone.

Grain quality was generally good with below average protein in wheat and ASW was the majority grade achieved. This was despite increased nitrogen applications to take advantage of the good rainfall.

Insect and disease pressure was low in the 2021 growing season.

The mice population is an ongoing concern. It is apparent now that in some areas, much more mice baiting should have been undertaken prior to the season breaking. The risk to canola in 2022 is high and baiting pre- and post-planting is planned.

Snails caused delivery issues along with ergot due to the late finish. A lot of grain, especially barley, is still being cleaned for delivery. Desiccated crop had far less ergot infestation and showed the value of crop topping in a long season.

2022 Season – looking forward

There may be more legumes being considered as they are cheaper to plant, however, pulse grain from 2021 remains unsold with poor market opportunities.

Barley area may decrease, with more wheat and canola taking its place in the zone. High fertiliser prices have dampened enthusiasm for cropping in the Esperance port zone. The timing and rate of the final nitrogen application will be difficult for 2022 and there may be more variable rate applications and use of liquid nitrogen products.