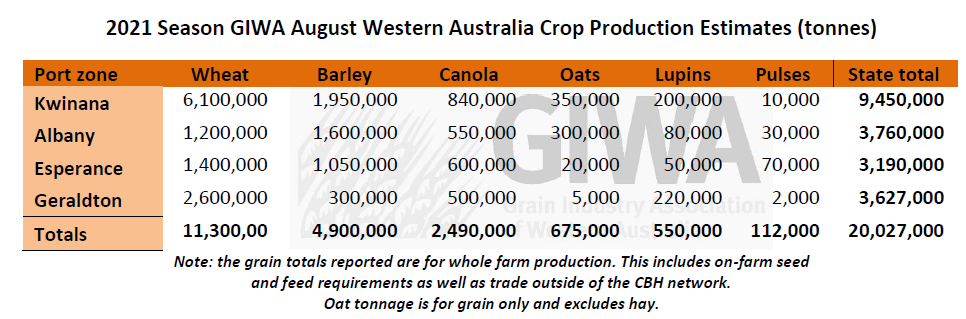

The 2021 Season – Looking firm for record tonnage of 20 million

Potential total grain production for Western Australia is firm at around 20 million tonnes heading into spring.

Based on current crop growth, timing of crop development, sub-soil moisture and the area planted, there is significant upside potential. Crop tonnage estimates rarely increase from this time of the year as unfavorable climatic events and other risks can substantially reduce the final outcome in most years.

Frost is shaping up as the greatest risk to achieving or exceeding the current estimated tonnage. Whilst there is a big spread in crop development across the regions which will help minimize the risk of large wipeouts from one-off frost events, the early start to the season means the whole crop will be exposed to a longer period of risk. An upside to this is that recovery from frost is likely to be better than normal due to the good levels of sub-soil moisture. The most recent Department of Primary Industries and Regional Development (DPIRD) forecast included in this report indicates that whilst “minimum temperatures are predicted to be lower than normal over September and October, the atmospheric pressure patterns are unlike those of 2016. A repeat of the exceptional number of events during September 2016 is unlikely given current model forecasts”.

Heat stress is still a potential threat as it is in most years, although the above average levels of sub-soil moisture across the state will help crops get through any spikes in temperature during grain fill. Crops have more top growth than normal and shallow root structures from the soft growing conditions. This could lead to a very quick deterioration in grain yield when the inevitable heat comes on.

The continued loss of crop area to waterlogging and the capacity of these areas to recover before harvest will have an impact on final tonnage in those areas worst affected.

The very good growing conditions have brought with it the increasing risk of mice damage to canola and lupins particularly in the northern areas of the state, and locusts to all crops in the eastern areas of the state. Foliar disease in all crops is starting to get going in the south and sclerotinia is a threat to all canola crops. Weather conditions leading up to harvest are forecast to be drier than average which will have a positive impact in what has been a very wet year to date.

With significant strain on the whole grain supply chain from the tight labour supply situation and well above average expected tonnage, harvest could be a drawn-out affair exposing growers to higher than normal harvest losses.

On balance, whilst most growers are experiencing one of the best years in recent times and a record tonnage is likely, there are still the usual risks out there along with some that WA growers have not experienced for a while.

Seasonal Outlook

Ian Foster, Department of Primary Industries and Regional Development

DPIRD climate summary

An exceptionally wet July has added to above average growing season rain to date, continuing waterlogging issues for parts of the Great Southern and South Coast. Soil water storage is above average for most of the cropping region.

Climate conditions in the Pacific Ocean are likely to trend towards weak La Niña conditions later in 2021. A negative Indian Ocean Dipole (IOD) event is now established, and most models predict this to continue for the rest of the growing season. This state is associated with wetter conditions over southern Australia, though there is a wide spread of outcomes for WA. Most climate models have neutral rainfall outlooks for the next three months over southern WA, although some models indicate below normal seasonal rain is more likely.

Frost risk appears to be close to normal this year. While average minimum temperatures are predicted to be lower than normal over September and October, the atmospheric pressure patterns are unlike those of 2016. A repeat of the exceptional number of events during September 2016 is unlikely given current model forecasts. Some frosts have already occurred, but the frequency is not unusual.

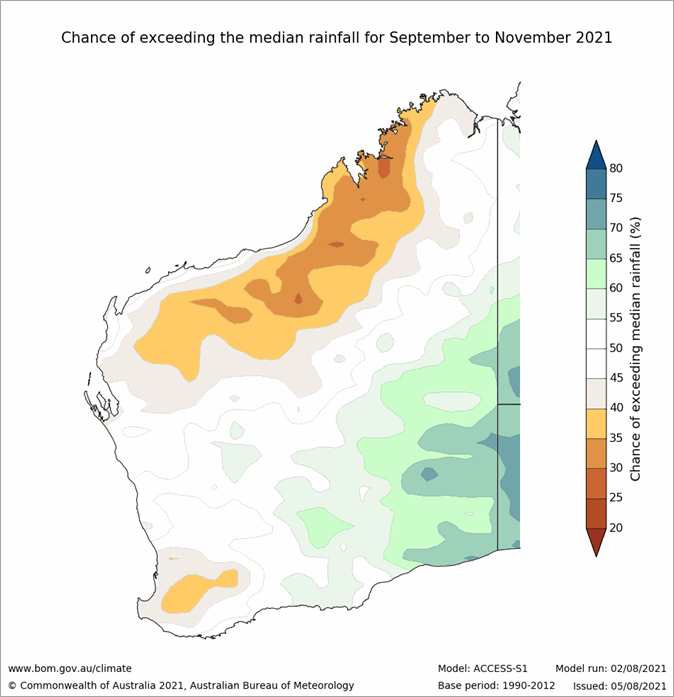

Bureau of Meteorology seasonal outlook summary, issued 5 August 2021

- Spring (September to November) rainfall is likely to be above median for the eastern two-thirds of Australia. Below median rainfall is likely for north-west WA and western Tasmania.

- Maximum temperatures for September to November are likely to be above median for the northern tropics and Tasmania. For much of the southern mainland, below median daytime temperatures are more likely.

- Above median minimum temperatures for September to November are likely for all of Australia except southern WA.

Additional information is available from:

- DPIRD: Seasonal Climate Information

- DPIRD: Soil Water Tool

- BoM: Seasonal Rainfall Outlook - weeks, months and seasons

- BoM: Decile rainfall for April to July 2021

- BoM: Seasonal Outlook video

- BoM: Landscape soil water balance

Figure 1. Chances of exceeding median rainfall for September to November 2021. From Bureau of Meteorology.

Geraldton Zone

The Geraldton port zone is on target for a record tonnage this year. The canola, lupins and most of the wheat went in a month earlier than last year and the rainfall has been higher. Growing conditions have been excellent all year right across the zone and the lower rainfall eastern regions are the best they have been for many years. There is very little fallow in the east and the resulting increase in cropped area will contribute significantly to total tonnage for the zone.

Nitrogen application rates have been higher than normal as it has been across the whole grainbelt. This is fuelling excellent crop health and has assisted in lifting crop grain yield potential to above average for all crops. At this stage, leaf disease and insects are under control except for the wet areas where there have been delays in getting control measures in place. Sclerotinia is shaping up as the main risk for canola and lupins due to the warm wet conditions. Most growers have opted for a “two spray” strategy earlier on in the year to protect the above average potential. Those that opted for this strategy will be a long way in front of those that were slower to react to the season.

Frost will be the first hurdle to get over in the next few weeks in order to achieve the current crop yield potential. This is followed by mice, then insects as the day temperatures increase heading into summer. The usual heat stress is expected to potentially have less impact due to the good levels of sub-soil moisture and advanced crop development.

Kwinana Zone

Kwinana North Midlands

All crops across the zone are in very good shape for this time of the year. The early start, good growing conditions and 15 to 20 per cent more nitrogen use has driven crops to a higher potential than 2016. 2016 had been shaping up as record year for tonnage in the region until the top was taken off by sequential frost events. Frost is again the main risk going into spring. It’s expected that even with some potential reduction in yield due to frost, the spread in planting dates, good levels of sub-soil moisture and very good crops in every corner of the zone, will mean current tonnage estimates will hold through to harvest. The incidence of sclerotinia in canola and lupins are the worst in years, and unprotected crops will take a big hit in grain yield. Mice are also causing damage to canola and lupins with most growers now baiting for the inevitable increase in activity as it warms up. Insect and disease pressure is low at the moment, although most growers are expecting to spray canola for diamondback moth closer to grain fill in canola.

It’s worth noting that oat hay area is down by more than half in the region, although due to the present excellent potential, production could be close to average.

Kwinana South

The Kwinana South is a zone of two halves as a consequence of weather.

Ten to fifteen percent of the western areas are severely affected by waterlogging and additional area is losing potential with every rainfall event. The early sown crops are holding up, although later sown low-lying country will end up with below average yields.

Further east, the grain yield potential is up to 50 per cent greater than normal for many growers. The dry area in the central portion of the zone has picked up some good rainfall in July and is now on track for above average tonnages.

Growers have spent the dollars to protect crops and push the potential with fertiliser this year in response to the good start and continued excellent growing conditions. Leaf disease in cereals is low, as is insect activity.

Kwinana North East

The whole zone is looking forward to one of the best years for a long time. Over the last couple of years there have been some very good strips in the east although the majority of the region has had some tough seasons. The huge areas of wheat in the zone are going to contribute significantly to the states total tonnage provided there are not any major downgrades in potential due to frost and heat stress.

Sub-soil moisture reserves are very good and the crops are running into head now which is perfect timing to minimise the impact of heat stress. Avoiding frost in the next few weeks will be critical in determining the final outcome for the region.

Albany Zone

Albany West

Total tonnage out of the region may be down on recent years due to less crop being planted as a consequence of the country getting too wet to get planting finished, coupled with severe waterlogging in the low-lying areas. There are some very wet areas where significant areas of paddocks are un-trafficable and will yield well below average, although across the whole region the total area is closer to 5 per cent severely affected and around 20 per cent affected to some degree.

Most growers do not expect crops to hit the very high yields of the 2020 season, although the good areas are looking very good and this will help to push paddock averages up. The biggest threat at the moment in the region for growers is rain, as a wet spring will quickly push those waterlogged areas up and will not allow growers to finish off crop protection programs. Frost is a threat as well, although a lot of the low-lying areas have already been downgraded from waterlogging.

Leaf disease is under control in most crops and growers are monitoring disease development for spot type net blotch in barley and sclerotinia in canola.

Albany South

The whole region has suffered from the above average winter rainfall and total tonnage will be below average now due to waterlogging. Up to 20 per cent of the intended crop area was not sown in some portions of the zone and up to 10 per cent will be sprayed out and re-sown when it dries out enough to get over the ground. The yield potential of these re-sown areas will be low. Canola has been severely affected, with up to 20 per cent of the area cropped to canola expected to yield about one third of average. The cereals seem to be handling the waterlogging a little better than the canola and the expected downgrade in tonnage will not be as significant.

More nitrogen has been applied than in the past, and the good areas where there is less waterlogging are in very good shape. The area affected by waterlogging in the region is substantial and will have an impact on tonnage produced although the impact on the total Albany port zone will be less as the good areas in the zone are very good and will make up for the loss of crop to some extent.

Albany East (Lakes Region)

Crops right across the region look fantastic as a result of the early start, good growing conditions and higher than ever nitrogen use. There are still good reserves of sub-soil moisture and barring some disaster, growers will be well up on average production. There are some very wet paddocks although the worst is confined to the very low-lying spots.

The major risk going forward is frost of course. Crops are early and will be vulnerable over the next few weeks. It is hoped that the wide spread in planting dates and moisture in the ground will help mitigate the risk of large wipeouts from frost in the spring.

Crop health is good with leaf disease levels low.

Esperance Zone

The whole Esperance port zone is looking good from top to bottom. There is less waterlogging in the region than further west, except for right on the coast which could put a cap on average grain yields. The crops are well grown and the drier areas to the north are having a very good year. As a result, it is expected the zone will end up with a record tonnage. There is still a way to go before grain is in the bin, although as there are no poor spots in the zone and even with some downgrades going forward, grain production is expected to be in excess of 3 million tonnes.

The “cream belt” in the centre of the zone is looking like 5 tonne plus for cereals and further north to the “Gums”, growers are having one of the best years for a long time.

Crops have been well protected from disease and insects to date, although mildew is just starting to crank up in the cereals and spot type net blotch is appearing in barley. Growers have adopted a “high production” strategy all year and more nitrogen than ever has been used on crops so the potential top end yields are there if the finish is about average. Insects are just starting to be noticeable in the cereals and canola, and some mice are starting to munch on canola pods.

Whilst there are risks ahead for the zone, it is difficult to see how a new record tonnage will not be on the cards.