A start to the Western Australian grain growing season in two halves

Several rainfall events over the last few weeks in the southern regions of the state have allowed seeders to start rolling with confidence that emerging crops will get through a dry spell on the available sub-soil moisture. But in the north of the state it’s a different story with soil profiles dry down to 80cm. The rain has been patchy in the central regions, with some areas underway with canola sown into moisture and other areas where canola has been sown into dry soil with growers hoping for a decent rain over the next ten days.

Growers have adopted a more cautious approach to sowing as last year’s difficult start for many is still fresh on their minds. In the past few years, canola planting would have been underway given the rain that has fallen in many areas and dry seeding would have started where there has been none. But many growers consider the very warm soil temperatures and lack of sub-soil moisture too much of a risk this year.

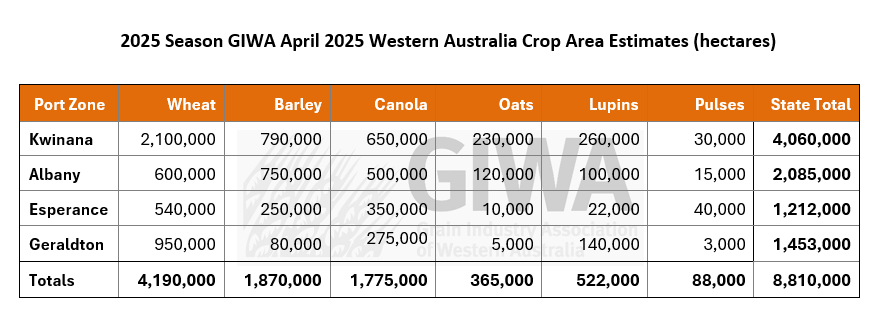

The wheat area in 2024 was up by around 500,000ha from 2023. Barley area was up by about 400,000 ha from 2023, and the canola area down by around 250,000ha. There was a large area of fallow sown to cereals in 2024 which is not available for plantings in 2025. The eventual splits on these three main crops will be determined over the next month. Whilst there is likely to be an increase in canola plantings, at the moment this will only occur if the rain showers we have been having over the last couple of weeks in the southern regions continue and the rainfall picks up in the northern regions of the state. Otherwise, growers will drop the break crops for the more secure cereals and drop more area out to fallow as occurred in 2023. As a result, the total area sown could easily hit 9 million hectares similar to last year with canola pushing well over the 1.8 million hectare mark if it rains. But, if it is dry and warm in May as forecast, crop area could drop back to 8.5 million hectares as it was in 2023.

The sustained price spread between CAG (GM) and CAN (non-GM) has seen the demand for Clearfield® canola and Hybrid TT seed increase this year. CAG canola deliveries across the state from the 2024 growing season exceeded 70per cent for the first time and this seems to have hit a demand driven price point where growers are making variety decisions based on this discount. Previously the yield and weed control advantage has negated any discounts in price.

The oat area across the state increased sharply last year, with much of the expansion occurring in non-traditional oat growing areas. Total oat area in the state increased by 38 per cent from 2023 to 2024, with oat area harvested for grain up more than this due to a greater proportion of oat plantings in the very dry 2023 growing season being cut for hay. Oat plantings intended for grain are likely to increase again this year due to strong early prices for milling oats. The oat area in this report refers to total oat plantings, noting the area destined for grain is usually in the 40-60 per cent range of total planted area.

Lupin area will increase in the northern half of the state if it decides to rain in the next month, although with limited markets for the grain and profitability very sensitive to price, it is unlikely the area will increase to any large extent.

There has been statewide interest in pulses in the last few years and with reasonable yields of lentil, field pea and chickpeas recently there are more plantings intended in 2025.

Seasonal Outlook

Ian Foster, Department of Primary Industries and Regional Development

Seasonal Climate April 2025

Rainfall

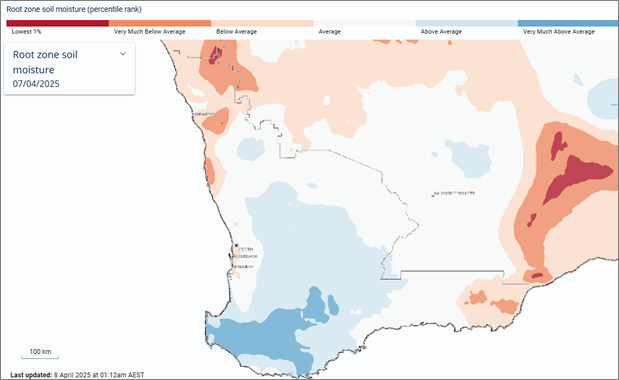

After a summer that has been much drier (and hotter) than normal over most of the cropping area, March and April to date have provided significant rain for much of the Great Southern and South Coast. Estimated root-zone soil water storage is higher than normal for the South West, western South Coast, and below normal for the northern agricultural area (see Figure 1).

Forecast

Climate conditions in the Pacific Ocean are neutral and are expected to remain neutral into winter. The oceans around Australia are much warmer than normal, providing increased atmospheric moisture that may influence the severity of weather systems.

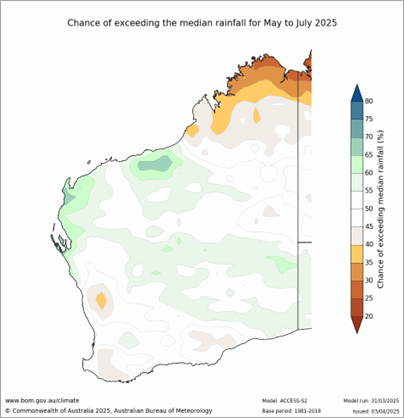

The Bureau of Meteorology’s monthly rainfall outlook for April expects below normal rain for most of southern WA, despite weather predictions of more rain for the South Coast mid-month. The seasonal outlook for May to July 2025 is neutral, meaning the normal range of rainfall can be expected (see Figure 2).

Figure 1: Estimated root-zone soil water storage 7 April 2025. Source: Bureau of Meteorology (2025)

Figure 2: Rainfall outlook for May to July 2025. Source: Bureau of Meteorology (2025)

Temperature

Seasonal temperatures over summer have been very much above normal. Seasonal forecasts indicate much warmer conditions will persist into winter.

Additional information is available from:

BoM: Rainfall totals for 2025 to date

BoM: Rainfall outlook for the next week

BoM: Seasonal Rainfall Outlook

Geraldton Zone

The extremely hot and dry summer is running into the start of the season in northern WA, with no significant rainfall since harvest, and completely dry soil profiles. Deep ripping began in early summer while residual moisture was available, but operations halted as it quickly dried up.

Soil temperatures have remained too high for safe dry sowing of canola, until a recent cool spell provided some reprieve. The region is planning a shift back towards break crops like canola and lupins after several years of cereal-heavy rotations, although lupin seed is hard to source. There’s also cautious interest in Clearfield® (CL) canola in parts of the southern Geraldton Port Zone, though weed resistance limits broader adoption.

Farmers are dry sowing small area of break crops and plan to adjust sown area depending on whether rain arrives before mid-May.

If timely rain falls, the area under break crops could rise 15-20 per cent, returning to historical averages near 400,000 hectares. However, ongoing dryness or a late break (after mid-May) would see more of this land revert to wheat or fallow. Weed control remains a key issue, especially after last year’s wet conditions reduced chemical efficacy. As a result, windrow burning has resurged to help manage seedbanks.

Interestingly, the region’s symbolic weather predictor—the albatross—has not been sighted, reinforcing predictions of a late or poor break.

Kwinana Zone

Kwinana North Midlands

Rainfall in the region has been a mixed bag with falls generally lighter in the west and not enough to get planting started into moisture. Rain to date has created a patchy and mixed soil moisture profile. While a few growers have cautiously begun dry sowing, others delayed operations, especially after last year’s difficult start. As a result, activity has been minimal apart from those with large-scale programs who are proceeding regardless.

Some of the eastern areas where growers have had 15-25mm of rain in the last few weeks have made a start on canola, but most are waiting to see if more rain eventuates out of the next few forecast rainfall events and this will determine whether they can sow into moisture, or whether the country will dry out enough to safely dry sow..

Canola and barley plantings are likely to increase from 2024 where both were scaled back due to the difficult start to the year. The total cropped area crop will increase slightly from the continued substitution out of pasture to crop, reflecting an ongoing shift away from livestock. The improvements in CL canola yields and ability to rotate with CL barley as well as the sustained price spread between CAG (GM) and CAN (non-GM) has seen the demand for CL canola seed increase this year.

Lupin area is likely to change little in the region as any substantial reduction in price quickly pushes the profitably negative on average grain yields. Pulses on the other hand look to be on the up as the small area of successful lentil crops in the region in 2024 will see growers continue to increase plantings. The same can be said for chickpeas and field peas. Export oat hay demand in the region has softened on the back of a very good production year in 2024.

Kwinana South

Rainfall has been mixed to date with areas across the eastern strip along the Great Eastern Highway, highlighting a clear divide between areas with good rainfall (50–70mm) and those receiving very little (10-20mm). Some growers are seeding canola into ideal conditions, while others, particularly large-scale operations, are sowing into dry soils based on seeding capacity and risk management needs. Despite the variability, plans remain canola-heavy, driven by profitability in previous years. Although there’s potential for a shift back to cereals, likely wheat, if moisture continues to be scarce. Bruce Rock exemplifies the contrast: the western part of town has had solid early rains, while the eastern side remains very dry.

Minor activity includes small areas of vetch, oats, and early wheat, but these are negligible overall. The current dry conditions contrast with previous years where summer rains allowed more confident dry seeding, and now even 30mm of rainfall is seen as marginal for sowing into hot soils.

Regarding crop types and inputs, most growers are sticking with CAG canola systems, valuing better weed control over small price advantages. Wheat remains dominant due to price and yield considerations, while barley continues to gain ground further west where rainfall is more reliable.

Fallow is rare and only used for targeted weed control, not as a structured part of rotations.

Kwinana North East

Recent conditions in the Southwest have been mixed, with promising rainfalls of up to 50mm in some areas, but very patchy distribution elsewhere. This has driven some early seeding activity, including oats for sheep feed and canola in limited areas. However, concerns remain due to the variable soil moisture profile. Growers in areas like Wongan Hills are already contemplating re-seeding canola due to poor initial establishment.

Ryegrass and other weed pressures are challenging barley growers, and with early sowing, there are concerns about herbicide effectiveness and rainfall timing.

Oats are seeing a resurgence, particularly in acid and frost-prone regions around Koorda, Beacon, and Goodlands. Their adaptability, feed value, and attractive price point make them a viable break crop. However, price volatility and weed control remain concerns.

Canola areas will largely depend on rainfall received before Anzac Day, with growers wary of dry sowing after lessons from previous seasons. Lupins are also at risk of being dropped from rotations without rain.

Fallow is expected to increase due to the dry outlook, especially among those without livestock, and growers are cautiously optimistic about hybrid TT canola varieties offering improved returns if conditions permit. Although the success of Hybrid GM varieties in recent years for their vigour and ability to yield under low establishment densities will see them take area from the old open pollenated varieties that dominated plantings just a few years ago.

Albany Zone

Albany West

There has been an unseasonally early start to the season across the Southwest, thanks to two significant out-of-season rainfall events. Rain totals ranged from 40-120mm across key areas west of the Albany Highway, followed by a widespread 30-40mm last week. This has built an excellent soil moisture profile, allowing pastures to recover well and easing pressure on livestock systems. While conditions are not “textbook” due to their timing, they’re highly favourable for both crop emergence and livestock logistics, with dam levels also being topped up.

On the cropping front, around 30 per cent of growers have started sowing — mostly canola, with CL varieties back in favour for similar reasons to other areas of the state. The larger and more cropping-focused growers are well underway with sowing programs, while the more mixed cropping/livestock growers have been a bit slower to get going. The rotation mix is stable, with a continued move away from RGT Planet barley toward Neo CL and Maximus CL. Oat planting intention remains unchanged from last year in the region. Overall, cropping is expanding modestly eastward where land is more suited to it, while livestock numbers are gradually stabilising after a period of decline.

Logistics remain a key challenge, particularly around knockdowns and weed management as the speed of growth of weeds and volunteer cereal and canola in stubble paddocks has caught many off guard.

Albany South

The majority of the region has had very good rain over the last month with all areas now close to 100mm for the year to date. Some areas have had more than this and have already changed programs to being barley dominate with the anticipation that if it is an average season from now, crops that are more sensitive to waterlogging will not end up yielding profitable returns.

Most growers are underway sowing canola and with the early start, canola area will probably be up on last year. The same can be said for barley as even prior to the early rains arriving, growers were planning a slight swing back into barley.

There is likely to be a slight increase in total cropped area driven by the continued exodus of sheep and with the early pasture feed now available, an extra crop paddock or two may go in as stocking rates can be increased on those paddocks planned for pasture.

The decline in sheep numbers in the western areas is likely to slow down as the areas suitable for cropping have mostly been taken up. In the eastern areas of the region there is still some adjustment out of pasture to crop that can occur, and in those areas there will probably be a similar reduction in pasture area to crop as has occurred last year of between 5-10 per cent.

Albany East (Lakes Region)

The eastern areas of the Lakes district have had good early falls of rain and growers have taken the opportunity to sow oats and more recently canola. Oats for hay were very profitable for growers in 2024 and even though stock levels are back up from the very dry 2023, where oats for grain and hay stocks were run down, there is still interest in increasing oat area in these lower rainfall regions when there are early planting opportunities.

The central and western portion of the zone have also had good early rains, although growers have been a little more cautious with sowing plans as it is still early and the risk of frost later in the season has tempered growers from putting too many hectares in just yet.

The early planting opportunity will see the area of canola increase from last year and there may be a slight increase in lupin area to give growers more break crop options.

The barley/wheat area swap will probably favour barley again as prices are holding up for now.

Esperance Zone

There has been a positive shift in grower sentiment following significant early April rainfall in the region, with some areas like Salmon Gums receiving over 40mm. Seeding progress varies widely, averaging around 30-35 per cent, with early sown canola, vetch, and pastures already emerging. While soil moisture has been short-lived due to warm post-rain conditions, it's a much stronger start than last year. Seeding has been concentrated in the west, with mixed wet and dry sowing depending on soil conditions.

Rain this week in the Mallee, central and eastern portions of the zone, which came out of the blue, will see solid plantings of canola now in these regions and planned areas going to crop in the lower rainfall regions.

Crop choices are shifting based on market signals and weed control options. There is likely to be a modest increase in barley hectares and a likely drop in CAG canola sown due to a ~$100/t price difference, although GM hybrid varieties are still preferred in low rainfall areas for their yield stability.

The new CL wheat varieties such as Tomahawk have renewed interest in Clearfield® systems. Oats are also drawing some attention again, with paddocks going in despite uncertain drivers. Bean and lentil excitement from late last year is tapering, with most growers opting for canola or field peas instead due to their current strong prices.

Overall, cropping areas are expanding at the expense of sheep and this is likely to continue this year.