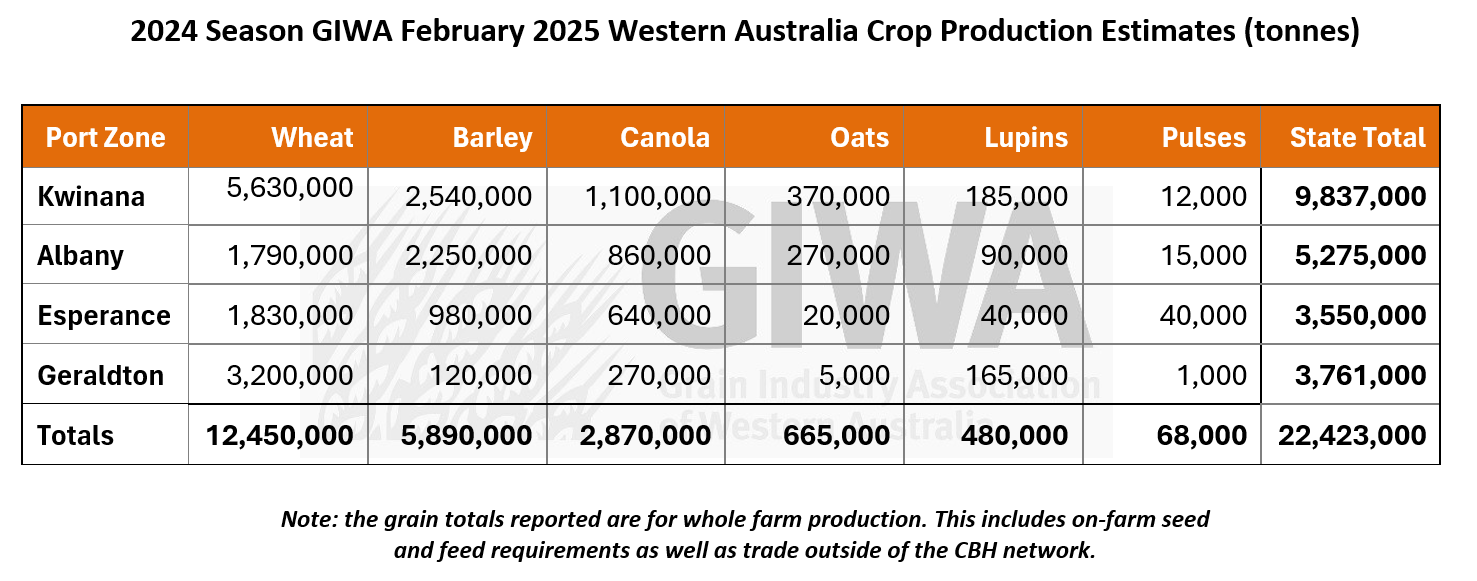

The 2024 Grain Season – Warm growing conditions fuelled another record grain production year in Western Australia

The 2024 grain growing season has ended up with the third largest tonnage on record. The previous records were in 2021 and 2022 where 24m and 26m tonnes were produced. 2021 was the warmest winter on record until that point and 2022 was seven per cent warmer, and 2024 was warmer than 2022.

This trend of warmer growing seasons appears to be an overriding influence on grain production in Western Australia.

2023 was one of the coldest winters since the 1970’s and whilst it was very dry in the northern agricultural zones, the remainder of the state was decile six to eight for rainfall. The area planted was just over 8.3m hectares, nevertheless only 15m tonnes of grain were produced.

All three record production years were also record areas planted with around 9m hectares sown. This trend of increasing cropped area is likely to continue due to the exodus of sheep. For every 1 million sheep that leave farms and are not replaced an extra 300,000 to 500,000 hectares are available for cropping depending on the rainfall zone.

2024 was a lower decile rainfall year than 2021 and 2022, but it had a very high area of crop sown on fallow. The area of fallow going into 2024 was around 1 million hectares where it normally is around the 300,000ha mark and this helped crops yield close to or exceed long term average grain yields in the lower rainfall regions south of the Geraldton port zone. This high area of fallow in some degree insured those regions by limiting their risk from a low rainfall year.

When you look more closely there are, of course, many small influences that have added up to contribute to the end result. The majority of these are human driven rather than climate driven and the adoption of modern farming practices with quick adjustments by growers, is aiding in these consistent results in widely different seasons.

The area of crop in the medium to higher rainfall zones of Western Australia, where historically sheep have been an important part of the farming system, are now becoming less important. The change in crop area from 2023 to 2024 highlights this with an increase of between 7 – 10 per cent in crop area being substituted from pasture due to the exodus of sheep. The crop area had been gradually increasing over the past five to 10 years, however, the contribution to the state’s tonnage is proportionally higher than the area suggests, simply because the majority of the area switching from sheep production to cropping is in the higher and more consistent rainfall zones. This is clearly demonstrated in the Albany port zone where the tonnage produced in 2024 was the highest on record for that zone. It was a good year in that zone with virtually no frost or waterlogging, but the increased crop area also influenced this result.

Grain yield estimates prior to harvest were up to 20 per cent lower than actual deliveries for some regions and this would have caused significant delays at delivery sites if this had occurred five years ago. However, infrastructure upgrades resulted in most regions handling the large tonnages produced in the recent record years fairly easily. The rain just prior to harvest and during the early stages of harvest resulted in significant downgrades in grain quality. Testing for falling numbers also resulted in a slowdown in delivery cycles and dragged-out harvest operations in central regions of the state.

Highlights of 2024

Total tonnage produced is obviously the main highlight and unpacking the one percenters that contributed to this, is a major area of work that is being completed by all sectors of the grain industry as we head into the 2025 growing season. Understanding these will help improve estimates of production and provide ever more accurate signals to the state’s grain customers in the lead up to harvest.

Wheat

The average grain yield for wheat was 2.74t/ha with 12.6 million tonnes produced from 4.59 million hectares planted. This sits within the higher range historically, with many individual paddocks achieving in excess of 20kg/mm of rainfall which is higher even than that achieved in 2022.

Wheat dropped from 57 per cent of the total cropped area in 2023, to 51 per cent in 2024. .

The massive grain production year in 2022 was markedly different to 2024 as there was more subsoil moisture to start the season, an earlier general break to the season and very mild temperatures in the spring. The very high water use efficiencies (WUE) of wheat in 2024 was in part due to very high floral use efficiency. The majority of grain sites that formed in wheat heads, set grain. This is not normally the case. Growers generally manage their wheat crops to bulk up the top growth in order to induce the maximum number of tillers, grain heads and grains per head, knowing that as the season progresses a percentage of these will be lost as the squeeze comes on in the spring from heat and lack of moisture.

Another factor that contributed to the very high tonnage, which most underestimated, was the impact on yield from the contribution of subsoil moisture. Post-flowering water use contributes three times as much to grain yield as pre-flowering water use. Even though there was very little rain during grain fill, there must have been more plant accessible soil moisture available than was thought.

In 2024 the growing season did the job for us by limiting the crop biomass which assisted in reducing the requirement for rainfall in the spring and most of the growing occurred in the winter when evaporation was less. The result was very efficient crops with very high potential and even with virtually no rain in the spring, crops were able to fill heads mostly on residual subsoil moisture. This is an important learning that growers have taken note of, and many will no doubt alter their fertiliser strategies in future to try and emulate last year’s results.

The rain across the central and northern grain growing regions over harvest resulted in large tonnages of grain being impacted by low falling numbers and so dropping out of the premium quality grades. Even so, other regions of the state made up ground on quality and the end result was that reasonable tonnages of these premium grades were produced.

The prompt instigation of utility grades in response to initial grain deliveries, including utility hard with high screenings, resulted in maximum dollar capture for growers. In saying this, the downgrading of significant tonnages due to low falling numbers took the shine off a good production year for many growers, with substantial reductions in price.

Barley

Barley production was 5.9 million tonnes from 1.77 million hectares planted for an average yield of 3.37t/ha across the state. Barley area was 19.7 per cent of the total crop area which is just below the highs of five years ago.

The malt barley/feed barley split was again in the 25/75 per cent range. More malt barley was produced in the southern regions than in the recent past with many loads hitting protein and retention specifications but then failing to achieve malt due to germ end staining.

The shift away from Planet barley that has been occurring in recent years due to the difficulty in controlling spot type net blotch is nearly complete, with most growers replacing Planet with the newer very high yielding varieties with robust disease packages. This will assist with keeping protein and screenings up by maintaining more green leaf area longer, resulting in more loads likely to hit malt specifications in the future.

The spread of production for barley and wheat where the premium grade varieties are now grown across different geographical regions, will help spread the risk associated with seasonal variability and further boost Western Australia’s capability as a reliable supplier of the higher specification grades for our customers. In the past we had the ‘malt belt’ and the ’noodle belt’ where the majority of these quality grains were grown. This is no longer the case and whilst growers still grow for tonnes, this spread in production across different regions will mitigate to some extent adverse seasons and climatic events.

Canola

Canola was probably the standout crop in 2024. Statewide production was 2.8 million tonnes from 1.65 million hectares planted for an average yield of 1.69t/ha, well up on historical averages with similar rainfall deciles.

Canola yields were exceptional in the higher rainfall zones with many around 3t/ha whole paddock averages. These high paddock averages were driven by the lack of waterlogging and frost which maintained more even production over the whole of paddocks, not just parts of paddocks as is normally the case.

Canola yields were also very good in the lower rainfall zones due to the very high potential of the new quick season hybrid varieties and growers committing to inputs now they are more confident of achieving profitable yield levels. The swing in and out of canola in the low rainfall regions will now likely be less erratic in the future, where historically the decision to grow canola was heavily based on existing subsoil moisture leading up to planting time and was very sensitive to early autumn rains required to germinate crops.

Barring hybrid seed production disasters, sufficient supplies of quality hybrid seed are now readily available and with prices for grain running in the higher decile ranges, historically, the opportunity to grow a profitable break crop is very attractive. Early indications are that canola plantings will be solid again in 2025.

Oats

The area sown to oats in 2024 was just over 320,000ha, which was 30 per cent more than that sown in 2023. This was due to strong price signals for milling oats at the start of the season, more so than hay pricing. Indications are that oat area will increase by a further 15 to 20 per cent in 2025.

The run down in hay stocks driven by a dry year in 2023 and a long dry summer resulted in a higher proportion of the area planted to oats being cut for hay than is normally the case.

Current prices for new season oat grain and the good yields achieved in 2024 in a dry year, with grain weights hitting the higher segregations, has renewed interest in the crop. The introduction of newer, higher yielding varieties and recent practice change where growers are now sowing oats much earlier in their cropping programs has assisted in the crop more reliably achieving higher yields and premium milling grades. The price/yield matrix at the moment is comparable to the other cereal crops. As well as this, oats are viewed as a ’break crop’ by growers and have a fit in the frost prone areas of the landscape.

The sustainability of the higher prices seen in 2024 is a question mark. In the past when production has exceeded 750,000 tonnes, the price has collapsed. The unknown this time around is, is the year-on-year increase in demand sufficient to support more tonnes grown? Compared to five to 10 years ago, there is now significantly more domestic accumulation capacity in Western Australia and this will buffer against the price crashes of previous high tonnage years to some extent.

Lupins

Lupin production is still kicking along at historically low levels and even the current high prices are unlikely to stimulate any significant increase in area planted in 2025. The continued reduction in sheep numbers is tending to keep a lid on area.

Seasonal Outlook

Ian Foster, Department of Primary Industries and Regional Development

Seasonal Climate January 2025

Rainfall

The past three months have seen above average rain over much of the northern and eastern agricultural area, with most of this occurring in November and December. The South Coast has been drier than average. Little rain has fallen over agricultural areas in February to date, and little is expected for the rest of the month.

Forecast

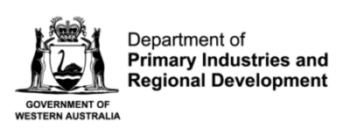

Climate conditions in the Pacific Ocean are neutral despite having a weak La Nina pattern. They are expected to remain neutral into autumn. The oceans around Australia are much warmer than normal, providing increased atmospheric moisture that may influence the severity of weather systems, or help tropical cyclones maintain strength off the WA coast (see Figure 1).

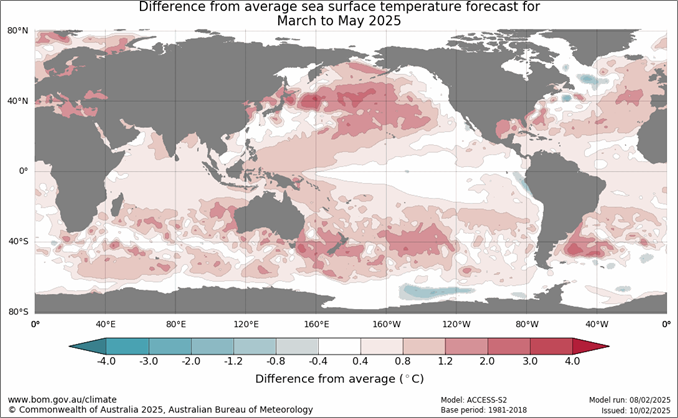

The Bureau of Meteorology’s seasonal outlook for March to May 2025 indicates a weak preference for above normal rainfall for much of WA (see Figure 2). International climate models have a spread of outlooks for this period. This time last year there was a strong consensus for drier than normal conditions.

Figure 1: Forecast sea surface temperature anomalies for March to May 2025. Source: Bureau of Meteorology (2025)

Figure 2: Rainfall outlook for March to May 2025. Source: Bureau of Meteorology (2025)

Temperature

Seasonal temperatures over summer have been very much above normal. Seasonal forecasts indicate much warmer conditions will persist into autumn, especially for night-time temperatures.

Additional information is available from:

BoM: Rainfall totals for 2025 to date

BoM: Rainfall outlook for the next week

BoM: Seasonal Rainfall Outlook

All Zones

The Geraldton port zone producing over 3.5 million tonnes of grain was driven mostly by the exceptionally good year in the lower rainfall regions. Wheat grain yields in these areas were well above any previous averages recorded.

The lighter soils away from these regions were poor due to too much rain and the timing of agronomic operations being compromised. The very short growing season did not leave any wriggle room on timing of fertiliser or crop protection operations, and this had a direct impact on final grain yields.

On the positive side of things, the rain facilitated a large program of deep ripping in the zone and combined with residual subsoil moisture, should set growers up for a good year if rainfall totals are close to average in 2025.

Wheat dominated the cropped area in the zone due to the late start to the growing season. This means there is now a lack of break country to plant on, other than fallow, and growers will be looking to increase the area of both canola and lupins in 2025 to get back to more balanced rotations. Barley area has been creeping up in the southwestern regions of the zone and much of these tonnes don’t come on the radar as most is delivered into delivery sites south of the Geraldton port zone. It is likely this trend of a gradual move back to barley will continue in 2025.

Kwinana Zone

The Kwinana zones accounted for 48 per cent of the total cropped area in 2024 and produced 42 per cent of the state’s grain. This is more than normal and reflects the very good year across most of the zone, including the low rainfall regions. However, not all areas were good and there were some poor holes where growers were well down on average. The zone average for wheat was 2.33t/ha which is a good result overall.

Canola yields were very good at 1.64t/ha across the zone and as far as profit goes, was close to wheat. Canola crops had a difficult season to negotiate with a patchy, late start, bug issues and weed control timing issues, although it seems to have come out the other end unscathed. Canola is maturing as a crop particularly in the lower rainfall regions and grain yields are becoming more consistent. Growers have also become more confident in fertilising for yield targets rather than just maintenance amounts. This has tended to make best use of the advanced genetics and allowed the superior vigour of the new hybrids to push yields up.

Wheat was also very good and even though crops were a little compact in growth habit, this was a benefit at the end of the season where most regions had little or very little rain in September but survived due to the soil profile being topped up in most regions at the end of August. Most growers were then nicely surprised once the headers got rolling and the tonnes started to come in.

Barley crops were sensational in the western regions and many growers have now cemented the barley/canola/barley rotation as the dominant rotation in the area.

Albany Zone

The areas of the zone closer to the coast and in the western parts had a very good year. There was a record tonnage of grain produced in the zone in 2024, even though there were some poorer areas north of the Ranges that had a difficult start and lighter rainfall all year. The warm growing season really favoured the canola crops and many paddock averages were in the 3.0t/ha range. The driver for the tonnes was an increase in area sown of between 7 - 10 per cent of pasture area substituted for crop and wall to wall, even crops across paddocks from the lack of waterlogging and frost.

Wheat grain yields were generally good, although grain quality was all over the place with seemingly no rhyme or reason as in some cases high screenings did not relate to high protein as you would normally expect. Protein was variable as well irrespective of grain yield, rotation and level of screenings.

There is likely to be an increase in oat area in 2025 and there is also some interest in faba beans again in the region.

Esperance Zone

The Esperance port zone had a reasonable year considering the low rainfall and patchy start to the season. Wheat in the region was a little disappointing as most looked better than it yielded, in contrast to the rest of the state where wheat crops in most cases yielded better than they looked. Esperance mostly escaped rain over harvest so avoided many of the falling number woes experienced in other port zones, but screenings were borderline for much of the crop. There was a lot of blending and cleaning to sneak into the higher quality grades.

Barley was solid, but only about 20 per cent made malt grades due mostly to low retention. The wheat/barley split looks like continuing with the 70/30 ratio it was in 2024. Grain production was nearly an identical split which clearly favours wheat over barley on price. The cost of disease control, mice issues in the following crops and other issues have tended to keep the lid on barley area in the zone.

Canola on the other hand has been going from strength to strength with growers continuing to hit profitable yields with the new hybrid varieties. The average grain yield from 2024 of 1.91t/ha supports this.

There has been some general talk about a swing back into pulses in the region as the pulse area has fallen away in recent years. The area was relatively active in trialling pulses in the past but due to troubles with weed control, disease and price, the area sown to pulses has dropped off to no be negligible. New, improved varieties together with the availability of better weed control options and more marketing options will probably see a bit of a resurgence in the next few years.